Unlocking sustainable success: Benefits of ESG for forward-thinking organizations

In today’s corporate landscape, environmental, social, and governance (ESG) considerations have garnered immense importance. Regulations such as the European Sustainability Reporting Standards (ESRS), which will come into effect on 1 January 2024, require organizations to implement the European standards for ESG reporting in the European Union. Companies in scope must therefore prepare accordingly, evaluating which topics they need to report and including data from their value chain, according to KPMG1. Getting ready for ESG reporting, however, goes way beyond compliance as it offers leverage for an organization’s transformation.

Every organization requires an ESG strategy, and its leadership needs to deliver. Most C-level executives have understood the significance and benefits of ESG as a game-changer. In an Ernst & Young survey, The C-Suite Insights: Sustainability & ESG Trends Index, which was conducted among C-suite leaders and executive management and published this year, every single respondent indicated that ESG matters are important to their organization, with the vast majority believing that related initiatives are very to extremely important to their businesses and long-term success. This is also reflected in the fact that 81% of the respondents said their organization had a chief sustainability officer (CSO) or equivalent position, while a few years back such roles were far less common.2

Understanding ESG strategy

At its core, an ESG strategy encompasses a comprehensive approach to address environmental, social, and governance factors within an organization. ESG reporting enables businesses to align their practices with evolving legal regulations and societal demands. For executives, leveraging an ESG strategy is more than merely checking boxes: at its best, it can help organizations bolster their competitive advantage while driving positive change. According to McKinsey, it is the CEO’s responsibility to garner support around the ESG projects that align to the organization’s mission and to link them to value creation.3

It is therefore pivotal for executives to use the momentum and energy of an ESG strategy to create a spillover effect in other areas, particularly where the organization is already working on creating strategic advantages. Executives can enable a smooth introduction of their ESG strategy by linking existing compliance topics to emerging ones. Often, it may not be necessary to create and introduce new processes as elaborating or expanding on the ones in place may turn out to be sufficient.

Unveiling potential ESG risks

While adopting an ESG strategy certainly offers advantages, neglecting its importance poses risks. According to McKinsey, numerous organizations that did poorly in environmental, social, and governance criteria subsequently faced significant declines in market capitalization.3 Nowadays, jobseekers and organizations increasingly pay attention to organizations’ ESG practices. Failure to prioritize ESG considerations can hinder talent attraction and retention as well as customer trust. The pursuit and implementation of an ESG strategy must be credible and robust enough to withstand public scrutiny; environmental and reputational risks, such as the perception of greenwashing, can jeopardize and undermine long-term sustainability efforts. Executives must avoid such pitfalls as failure to embrace ESG practices may also result in missed opportunities where public bodies favor ESG-aligned companies in bids, investments, or subsidies.

Unlocking ESG benefits for organizations

Embracing ESG delivers more than compliance with legal regulations; creating and implementing an ESG strategy can result in a plethora of benefits, making organizations more sustainable, attractive to investors, and even enhancing financial performance. Addressing ESG factors often yields multiple positive outcomes: For example, optimizing energy consumption not only alleviates legal pressure and saves the organization money but also has a positive ecological impact.

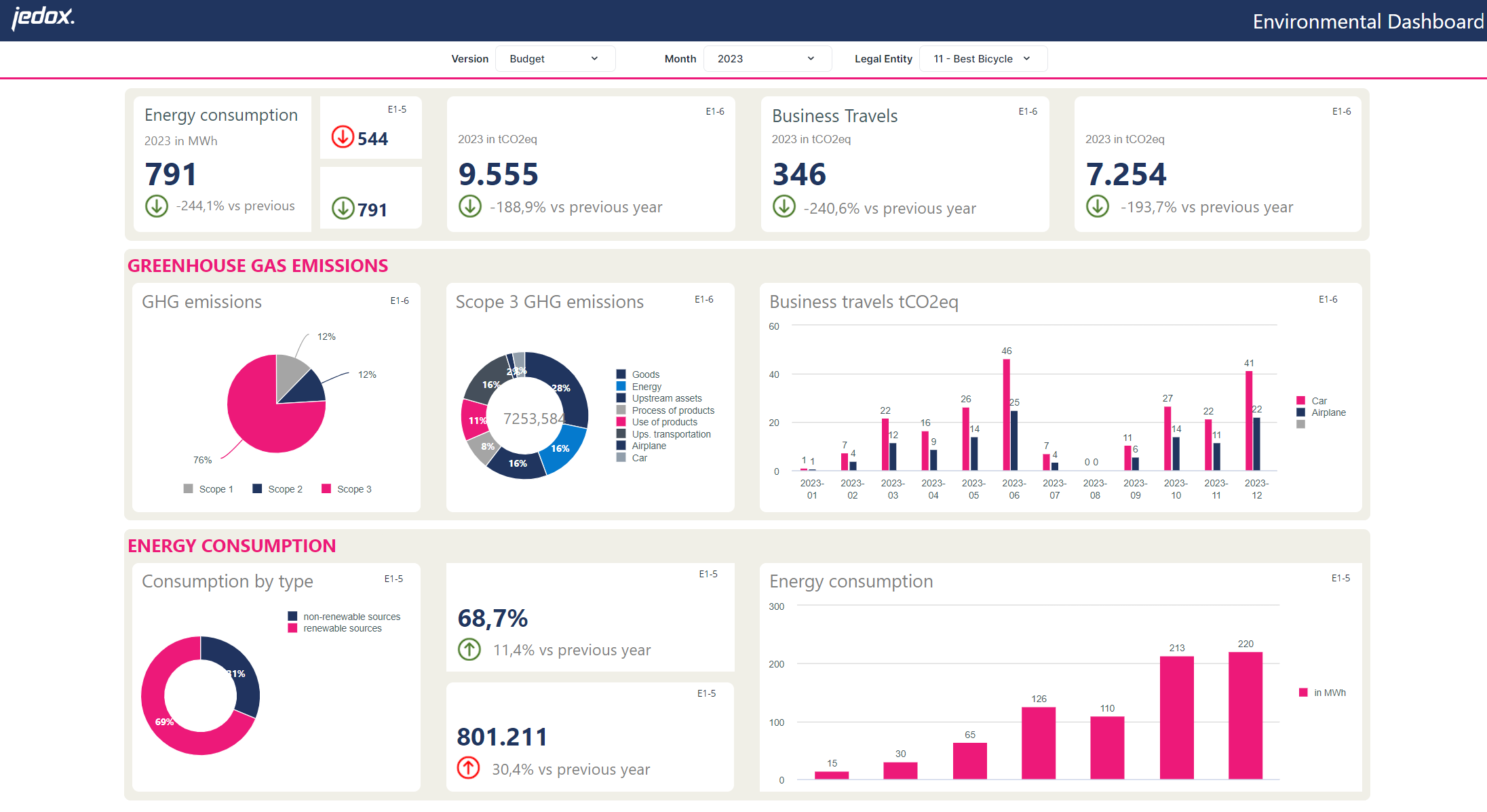

ESG Environment Dashboard

Effectively tapping into the benefits of ESG reporting requires a tool that enables access to all relevant data. In the software selection, executives therefore need to put emphasis on an automated integration that works across their organization’s software landscape. The ability to apply all data, ranging from travel management systems (environmental) to HR systems (social) and ERP systems (governance) via powerful integration capabilities enables a comprehensive approach to ESG reporting. Connecting operational information with the corresponding financial data enables an accurate assessment and a clear analysis of key performance figures to help streamline processes and realize the potential for optimizing the business. Having a common understanding of the entirety of the organization’s data creates the foundation for establishing a unified language across different departments.

Expanding focus beyond reporting and using ESG insights for planning, target setting, and execution can bring even greater rewards. Our previous blog post explores the correlation between ESG and finance, highlighting how ESG initiatives can foster a more robust image, build customer loyalty, and drive profitability.

Successfully implementing an ESG strategy in an organization

Implementing an ESG strategy in an organization is a complex task and executives must account for that. It requires a multifaceted approach. It is important to consider existing business practices, set clear goals, ensure top-level support, and rely on in-house expertise along with consultants who understand the complexities of the organization. For a smooth implementation process – particularly without a software tool with powerful data integration capabilities – the following points are crucial:

- If possible, the ESG strategy’s implementation should not rely on just one person or department alone; or worse yet, on a new hire.

- All available in-house expertise is required, involving necessary experts from departments across the organization to make ESG reporting a joint exercise and truly collaborative effort.

- A dedicated and consistent project team of seasoned employees needs to be in charge of implementation.

The benefit of expertise also extends to software tools: it’s best to use existing ones that can also be applied to ESG reporting. This not only saves time but also ensures that your staff is already familiar with the software. With a software tool effectively guiding staff through double-materiality and the usage of the tool itself, employees will learn on the job and an organization’s ESG reporting will require significantly fewer human resources. Watch our on-demand webinar to discover how Jedox can help organizations incorporate ESG into their strategic planning process.

Jedox, for example, is an ESG reporting software that integrates with finances and can be easily adapted. Jedox models can be adapted for ESG by an organization’s employees on a very high level and specifically customized to account for unique requirements.

With the out-of-the-box Jedox ESG Best Practice Accelerator (ESG BPA), executives can boost implementation and take their ESG strategy to the next level: the ESG BPA comes with a dashboard for social, governance, and environmental metrics, and within minutes staff can set targets and create and manage the respective initiatives to achieve those. These initiatives can be projected into the integrated profit and loss (P&L) and cash flow for strategy planning.

Leveraging ESG for value creation with Jedox

Truly leveraging the power of ESG requires a shift in mindset. Rather than viewing it as a cumbersome, mandatory task, executives need to seize the opportunity to initiate positive change in their organizations. By integrating ESG objectives with identified areas for improvement, executives can transform their organizations, addressing both sustainability goals and strategic imperatives simultaneously. Using ESG as a vehicle to rethink existing processes offers the greatest leverage for value creation through the full potential of ESG. Learn more about how Shelf Drilling managed to advance its sustainability objectives.

As a proven platform, Jedox helps organizations create value with its integration capabilities, as it automatically collects and reports data across the organization with its Best Practice Accelerator, from many different locations worldwide, thereby saving copious amounts of time. Additionally, using the Best Practice Accelerator provides continued compliance with legal regulations. The insights resulting from the comprehensive ESG reporting via Jedox enables executives to optimize their organizations long-term sustainability investments. Jedox provides actionable data metrics for taking charge of reducing business costs, avoiding loss of share price as well as incurring reputational damage. With its easy-to-implement Excel add-in, Jedox enables getting relevant ESG data, models, and reports across the organization, thereby fostering collaboration in the familiar work environment.

Getting your finance team on board with your ESG strategy

To ensure the successful implementation of an ESG strategy, finance teams play a pivotal role and can streamline data management, analysis, and reporting. By optimizing financial operations with ESG objectives, organizations can effectively measure, monitor, and communicate their sustainability initiatives.

Executives can make their finance team valuable allies for successfully implementing their ESG strategy. By involving them early in the process and benefitting from their expertise, the execution of the ESG strategy benefits as potential roadblocks can be identified and best practice established. The finance team’s motivation should be leveraged as they stand to significantly benefit in their work: a software tool for ESG reporting that enables automated data collection eliminates the tedious, manual effort of having to handle myriads of data points in endless Excel spreadsheets. This frees up the finance professionals’ resources for more strategic tasks. It is equally important to keep in mind that redundancy in processes should be avoided; whenever possible and expedient, existing processes should be used for ESG reporting.

Lastly, a crucial point for the finance team’s buy-in to an ESG strategy is for leadership to show them their commitment to ESG and their continued support. Giving the team the necessary authority for the execution of the ESG strategy and supporting them in establishing the appropriate network will facilitate close alignment and empower them to deliver on the strategic ESG objectives.

Conclusion

ESG has become an integral element of corporate strategies, and C-level executives must recognize its transformative potential by fully tapping into ESG benefits. By embracing ESG considerations and leveraging their employees’ expertise from their strategy’s inception, executives can set their organization up for success in improving long-term profitability, resilience, or stakeholder relationships.

Reaping the benefits of ESG opens doors to a more responsible and successful future. With Jedox, executives will have a reliable partner for ensuring their organization’s ESG compliance and realizing the value of their ESG strategy. Request a personal live demo today.

Sources

3 McKinsey, Five ways that ESG creates value