How AI and workflow expand the boundaries of digital business partnering and finance team value creation

Effective communication and collaboration are no longer just nice-to-have — they are essential for driving success. The Office of Finance is at the heart of every organization, overseeing financial strategy, risk management, and operational efficiency. Often it is a challenge for finance teams to align with stakeholders across business units, departments, and time zones. This is especially true for global teams in hybrid remote working environments.

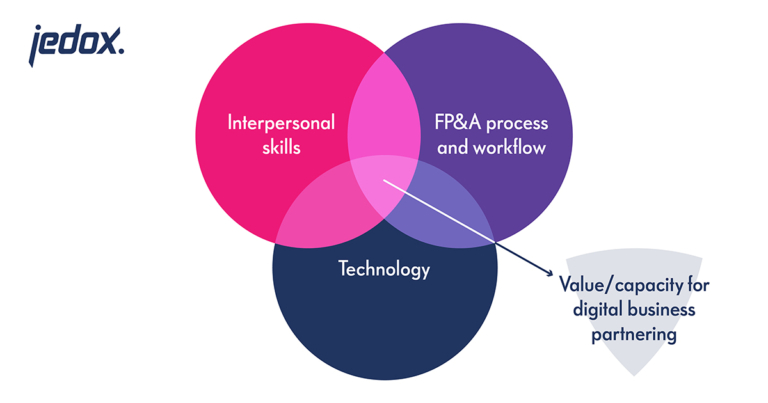

Effective collaboration and communication require a combination of personal skills, process, and technology to focus efforts where finance team expertise is needed most. This combination is ultimately how finance leaders become great business partners. As organizations establish the processes and implement the technologies that best fit their organization’s needs, more value is created for the organization.

Let’s have a look at different processes within the Office of Finance and how the use of AI and other workflow automation tools speeds up those processes to further digital business partnering.

Why ‘digital business partnering’ is important — decision support

Great business partnering is about being completely stakeholder-focused. It requires a deeper understanding of stakeholder priorities, more effective communication, a greater holistic view, and a focus on achieving stakeholder goals. By effectively managing AI-powered hyperautomation, finance teams can become more self-sufficient, focusing on collaboration and communication while using a digital representation of the business to drive performance. This digital representation is based on key drivers of the business. Key driver analysis, augmented by AI, reveals critical factors for success and turns raw data into actionable insight through the creation of a digital replica — or “digital twin” — of the organization.

Finance professionals will still need quantitative skills to understand and validate the output of hyperautomation, but new key skills for finance professionals must be nurtured and developed: communication, business acumen, relationship building, and leadership. This will help organizations move from siloed planning to integrated business planning (IBP), enabling teams across departments to collaborate through a single, unified platform, so even the most complex businesses can accomplish straightforward planning. This will uncover opportunities, discover gaps in the business landscape, and develop a range of scenarios. The result? Better decisions and better insights across the organization.

Characteristics of the ideal FP&A process that result in good decisions:

- Iterative: instead of waiting for the handover between the teams, the different views of decision-makers in the organization flow together to continually refine the plan

- Collaborative: instead of siloed planning, cross-functional teams across finance, sales, HR, and more come together to exchange information and make confident decisions together

- Consistent: no need to prepare figures provided by one group for another, because key metrics are aligned across all groups

- Strategic: plans and decisions are nonreactive – they are based on the big picture and support mid- and long-term business strategies

Release team pressure and create capacity through Machine Learning (ML), Generative AI (GenAI), and workflow automation

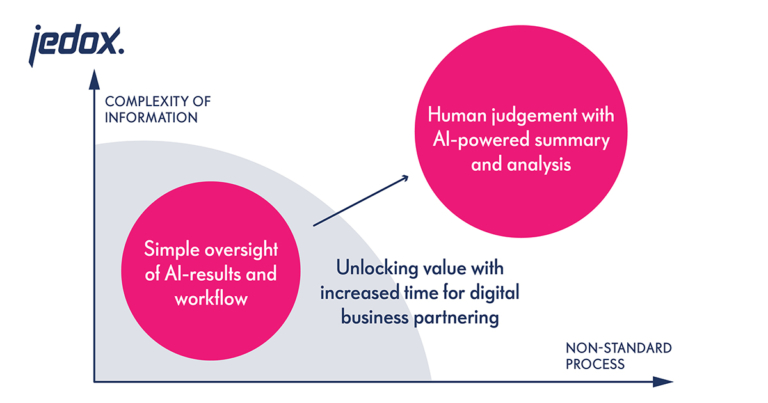

Low complexity and consistent scenarios and processes are perfect for leveraging AI and workflow automation to unlock time for focus on high complexity information. By automating routine tasks and providing valuable insights, AI empowers finance teams to focus on strategic initiatives and make more informed decisions. Workflow automation can also significantly enhance the efficiency and accuracy of your financial processes.

However, it’s essential to remember that ML and GenAI are tools, not a replacement for human analysis and judgment. Some perfect use cases for the combination of AI and workflow:

- Data consolidation: Automatically collect data from various sources, such as sales, production, and supply chain systems, to create a unified view of the business.

- Demand forecasting: Analyze historical sales data, market trends, and external factors to generate accurate demand forecasts.

- Inventory optimization: Optimize inventory levels by analyzing demand patterns, lead times, and carrying costs.

- Exception reporting: Identify deviations from plan and highlight areas requiring human intervention. For example, if a forecast error exceeds a certain threshold, the system can flag it for review.

- Scenario analysis: Quickly evaluate the impact of different scenarios, such as changes in product pricing or economic conditions, on financial performance.

Consider the Sales and Operations Planning (S&OP) process

S&OP process requires cross-functional collaboration involving sales, marketing, finance, operations, and supply chain teams to align forecasts, inventory levels, and production plans. It’s a complex process that often relies on manual data collection, spreadsheets, and email communication. These methods are prone to errors, delays, and miscommunication.

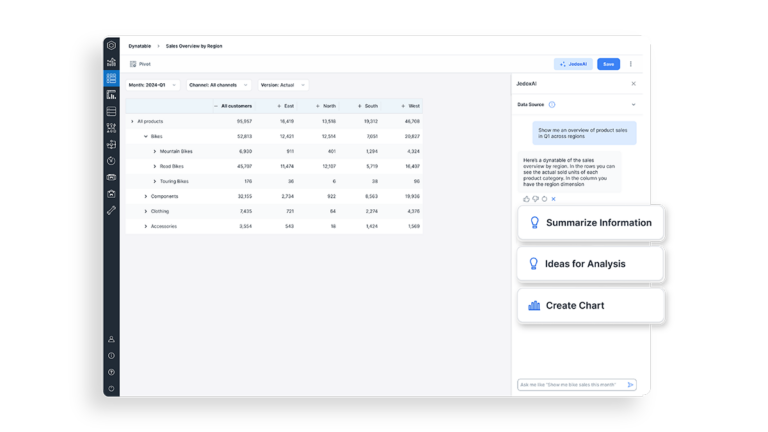

Software solutions like Jedox with AI and workflow can transform the S&OP process by automating many of its core components. Here’s how:

- Data Collection and Consolidation: Centralized platforms allow for real-time data collection from various departments via workflow tools and AI supported data preparation. This eliminates manual data entry and ensures data consistency.

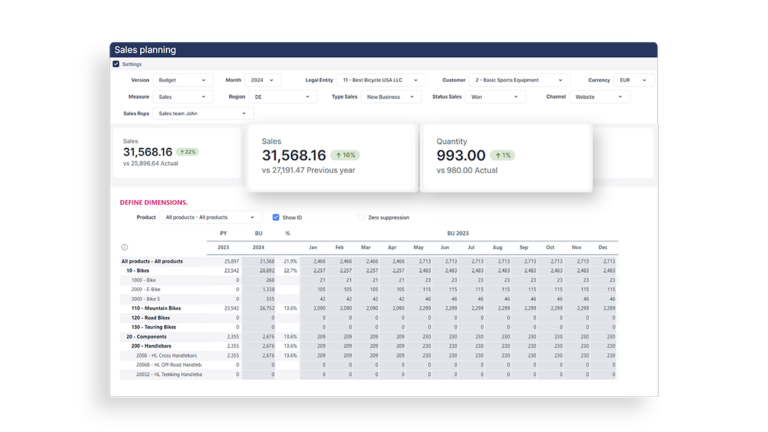

- Forecasting and Planning: Advanced forecasting tools with machine learning like Jedox AIssisted(tm) planning provide accurate predictions based on historical data and market trends especially in low complexity, non-volatile environments. These tools can also support scenario planning and what-if analysis.

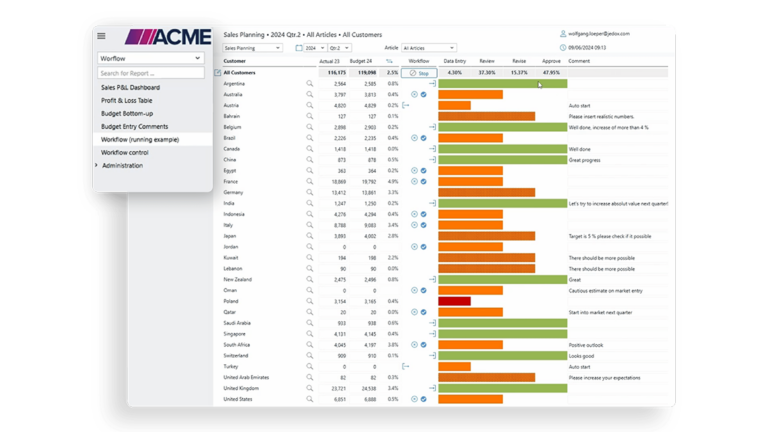

- Collaboration and Communication: Collaborative platforms that include workflow automation and GenAI enable teams to share information, provide feedback, and make decisions in real-time. This fosters transparency and accountability.

- Report Generation: Automated report generation leveraging Large Language Models (LLMs) saves time and reduces errors. Key performance indicators (KPIs) and metrics can be easily tracked and analyzed.

- Decision Support: Advanced analytics, summarization and visualization tools that incorporate GenAI provide insights to support data-driven decision-making.

By automating these tasks, the efficiency and effectiveness of S&OP processes gets significantly improved. This translates into better decision-making, reduced costs, and improved customer satisfaction.

Spotlight on Andros – Forecast covers 99 weeks for their business units

Andros, an organization that produces fruit, vegetables, and fresh food products for international markets was able to improve sales planning and reporting by implementing Jedox software. The software provided them with a powerful reporting platform, access to a central data pool, and the ability to respond to short-term market developments.

Six key considerations when selecting hyperautomation and autonomous finance technology to support an organization’s move towards “digital business partnering”

Integrating strategic, financial and operational planning and performance management should, ultimately, lead to more accurate and simplified plans, forecasts, and performance tracking. Different teams should have the ability to create their own reports and analysis functions or combine data in virtually any way that makes sense for them – seamlessly and autonomously.

Ask the following six questions to determine the best solution:

- Does the solution provide unified, collaborative, and cross-organizational planning supported by workflow automation?

- Does it offer enough adaptability and scalability to grow with the organization?

- Can it break down data silos by surfacing insights via a common understanding of the business?

- Does it support hyperautomation and seamless integration with all data sources?

- Are modern capabilities, such as GenAI and machine learning, available?

- Does integrated AI enable teams to tie financial and operational results together to provide detailed, nuanced insights?

By investing in the right software solutions and leveraging workflow automation, businesses can create a more efficient, collaborative, and data-driven finance organization. The result is a finance team with deeper understanding of stakeholder priorities, a wider view of the organization, and a focus on achieving stakeholder goals. This will not only improve your bottom line but also position the finance team as strategic, digital business partners for the business.