Behold the Emergence of CFO 4.0

No role in the company has undergone a bigger development than the role of the CFO. From bean counter to business partner, the same development has flowed through the finance function: from cost center to profit driver. These are at least developments that external stakeholders are demanding from Finance and the CFO. However, the global pandemic has revealed that we are not there yet.

Finance was thrust into the center of decision-making as the pandemic hit. Providing visibility into a near zero-visibility environment and ensuring that the company could continue to operate in a society that nearly came to a complete halt overnight. They’ve even acted as saviors of the company by cutting cost, preserving cash, and managing risk daily.

This was no easy task and unfortunately many CFOs and finance functions did not deliver to the expectations of stakeholders. Those that did though are of a new breed of CFO. We can call them CFO 4.0. They have accepted that their roles have changed and are living and breathing the changes daily. First and foremost they have changed their mindset to the new reality.

The mindset of a CFO 4.0

A recent survey I ran on LinkedIn showcased that to create the future of finance our mindset is what gets mostly in our way. Of close to 1,500 respondents, 62% voted for mindset when choosing between that, people, processes, and technology. The result was overwhelming and should cause us to look closer at the mindset of a CFO 4.0 and what it will take to change that mindset.

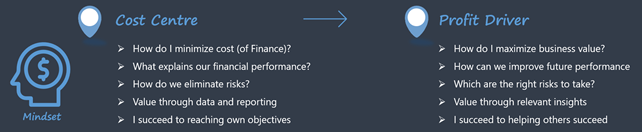

In popular terms, we say that the CFO should change their mindset from a cost center to becoming a profit driver. What does that mean though? Below you can see the key shifts CFOs should make to earn the 4.0 designation.

This will not be easy but is a necessity for CFOs to remain relevant. Another important element in making the shift is also to spend time and resources differently. Today finance functions spend around 70% of their time on working data, reporting, and analysis. This must change as well in favor of creating insights, influencing decisions, and impacting the shareholder value creation in the company.

What can CFOs do now?

The CFO should be business partner #1 to the CEO in the company and act as a role model for everyone else in Finance. If this is not the case, Finance will never get the impact the function could potentially have. We have uncovered that it is the mindset that too often gets in our way. So what can you do already now to change things around? Firstly, you can do some self-reflection. How would you answer the below questions?

- How much time did you spend with your finance team vs. business leaders in recent weeks?

- How many important decisions did you influence lately?

- Do you know if your business stakeholders are happy with the support that you provide?

- How are you leading the finance team to also become (better) business partners?

- What is the focus of your current finance transformation project? And how much of that relates to changing the mindset of the finance function?

The answers to these questions will give you a clearer idea of where you are yourself on the mindset change journey. It will also help you to understand if you need new initiatives to get your finance function to where you want it to be.

To shed some light on this journey, download the new eBook “Welcome to Finance Function 4.0.” It is time to change the mindset of CFOs and the finance function to enter the age of 4.0. Are you ready?