The five-phase, best-practice approach to improve FP&A management reporting

Best practices and greater technology utilization can help organizations enhance management reporting, increasing operational insight, strategic decision-making, and business value.

Mastering management reporting

Management reporting provides finance teams and C-suite executives with timely, data-driven insights into their organization’s activities and overall performance. These insights are crucial for improving decision-making and driving greater business value. However, many organizations struggle to optimize their management reporting practices. They often fail to fully leverage advanced tools that can help identify both challenges and opportunities. As a result, managers and top executives are frequently left disappointed.

Effective management reporting is more about providing structure and presentation and less about displaying numbers. Jedox’s Solutions Advisory Consultant Wolfgang von Loeper and business partnering expert Anders Liu-Lindberg elaborated in a webinar about the best practices to achieve excellence.

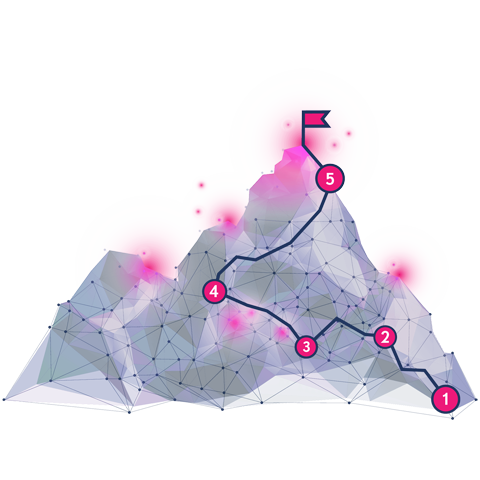

The best practices outline five phases that demonstrate how financial planning and analysis (FP&A) teams should approach management reporting to enhance their results. This straightforward strategy is best represented by asking several pointed questions (see image below) that help organizations define challenges and circumstances, outline solutions, and implement the next steps. Here’s a deeper dive.

Situation

What is the financial status?

How are you doing as an organization? Where do you expect to be? These questions help organizations describe their financial results, including sales and costs, for the period and what’s driving it. It’s important to present only facts, not opinions. An FP&A team doesn’t need to show all the numbers, only the pertinent data in the main presentation. Any remaining details can be presented in the appendix. It’s paramount that an FP&A team ensures data is up to date, accurate, and trustworthy; otherwise, it could negatively impact decision-making.

TOP TIPS

- Be factual. Leave out opinion.

- Know, but don’t show the details in the main presentation.

- Make it visually appealing, which tells a story versus using tables.

- Don’t use financial jargon.

Complication

What are the key attention points?

An FP&A team then needs to ask, “So what?” This is crucial because it helps them dive deeper into insight or information they don’t already know but that can help them make better decisions. They may spot a challenge affecting performance or reveal a time-sensitive opportunity. The team must investigate and analyze these critical attention points that are relevant to decision-makers. This means interpreting and quantifying these points, speaking to the right people to learn more, and telling the story behind the points. This information subsequently must be presented to decision-makers to ensure the points align with the key challenges.

TOP TIPS

- Ask “So what?” until you get to the core.

- Synthesize, don’t summarize.

- Think like a journalist in asking, “What’s the story?”

- Get buy-in with attention points before moving ahead.

Resolution

What can we do about it?

An FP&A team must determine the next steps and devise recommendations. After highlighting the key attention points, they should ask, “Then what?” What solution can mitigate the risk or take advantage of that opportunity? What are the next steps? It’s about discussing potential recommendations and proactively presenting an actionable solution that addresses the problem. However complex this issue may be, the team should provide recommendations and then validate them with decision-makers.

TOP TIPS

- Present, don’t dictate, several options.

- Present your opinions and recommendations.

- Create a prototype/solution for stakeholders.

- Be assertive, positive, and respectful.

Arguments and Facts

How can you back that it’s a good idea?

Once ideas or solutions are proposed, an FP&A team must corroborate them with a solid argument based on evidence and facts, verifying that this is the correct move. In other words, the team must prove their solutions are the best way to go forward. It’s best to highlight three arguments with as many facts as needed to win over people’s support for a particular recommendation.

TOP TIPS

- Present no more than three arguments. More than that and people can’t remember.

- Build credibility for the solution through good evidence.

- Consider “soft” evidence as well. It doesn’t have to be financial all the time.

- Leave out facts that don’t support the argument.

Call to Action

How do we get started?

Once the recommendations are proposed, a team should ask, “What do we do now? How do we get started?” Team members must present a plan to implement their solutions and get buy-in from decision-makers. The plan should be offered to decision-makers, and the team should seek their approval. The point is that it should be easy to take the next step.

TOP TIPS

- Summarize the discussion.

- Anticipate the most obvious questions.

- Read the body language of decision-makers.

- Remember to ask for a “yes.”

How Jedox solutions helps

Finance teams often spend a significant amount of time and effort collecting and analyzing data from across an organization. However, this reduces the time available to prepare management reports and communicate that information in a clear, presentable format for decision-makers.

The imbalance highlights a need for improved data management and automation tools like AI and machine learning to free up time for more value-added activities. As a result, finance teams can reduce the time spent on data collection and focus more on providing strategic insights and recommendations. In other words, many organizations won’t need to spend much time determining their financial status before identifying key attention points.

Finance teams also often struggle with preparing and presenting data in a manner that effectively communicates its significance to decision-makers. There may be a communication gap between the relevant data and how it is visualized in a management report. Advanced technology can bridge those gaps.

The big picture involves best practice technology approaches

Solutions built with the Jedox planning and performance management platform simplify the complexity of management reporting with an adaptable, automated, and efficient system that can model any scenario. Organizations often use pre-built Best Practice Accelerators that have templates that can be customized to create effective reports and dashboards. For example, the Integrated Financial Planning Best Practice Accelerator is based on hundreds of successful Jedox customer implementations. This versatile functionality allows users to display anything from the granular details to the big picture.

Jedox consolidates an organization’s data into a ‘single source of truth’ to ensure consistency and accuracy. The management reporting software automates data collection, processing, and integration from CRM, ERP, and other systems. The data is then visualized in seconds, delivering trends and insights for decision-makers. Several integrated capabilities ensure users are getting the best possible information. They include:

JedoxAI. This feature is an AI-driven, natural language processing tool that interacts with users conversationally. By incorporating a company-specific, secure, large language model (LLM) into an integrated business planning process, FP&A teams can add qualitative context to the data, meaning the advanced technology generates sound predictions and interpretations. Research studies have shown that LLMs are incredibly good at analyzing financial information and then writing narratives, such as executive summaries, even better than auditors in some cases.

AIssisted™ Planning Wizards. With AI, FP&A teams forecast revenue, demand planning, and cash flow. Designed to support self-service, AI-enhanced analysis within the finance team, this capability can quickly identify internal and external drivers that impact organizations the most by analyzing large datasets and then providing a highly accurate prediction of where an organization’s business might be headed. AI can also help recognize risks and opportunities across different regions, products, and customers, identify at-risk customers and provide strategic scenario modeling, such as predicting best- and worst-case scenarios.

Jedox dashboards built with Canvas technology. This feature allows users to easily choose, drag, and drop content from various reports, workbooks, and Views for presentation into a dashboard.

Jedox Add-in for Excel 365. This provides access to models and reports stored in Jedox and increases planning collaboration throughout the workforce. Within the Excel environment most professionals know and understand, users can modify, plan, or budget data with permission-based writeback capabilities. Report builders can quickly pull data, build reports, and publish reports for management or other stakeholders. The Excel look-and-feel of Jedox allows finance teams to extract more value without needing extensive technical knowledge or training.

Multidimensional single source of truth. Jedox software can cross-pollinate relational and multidimensional databases into one dashboard, allowing users to connect, drill down to, and filter information for in-depth analysis and comparison. The software provides unified and integrated profit and loss, cash flow, and accounting balance sheet forecasting, planning, analytics, and reporting. This leads to more ideas, analyses, investigations, insights, evidence, and solid recommendations. This is next-level strategic planning.

Conclusion

Effective management reporting empowers FP&A teams to tell insightful and compelling stories based on relevant, timely, clear, and accessible data and information. If appropriately packaged and presented, these stories are easy for decision-makers to read and interpret. As a result, they will feel more confident in determining the next steps for their businesses.

Jedox’s best practice for management reporting encourages organizations to think critically about a report’s structure, presentation, and content. Under this approach, stakeholders ask the most straightforward questions, such as “So what?” and “Then what?”, to ensure they present the most critical information to help executives. However, many organizations rarely ask those questions and, as a result, seldom get to the depth needed to uncover the insights required to make better decisions and to act on them.

Organizations need to change their mindset regarding how they approach management reporting. They should embrace the technology available to them now and expect advancements — namely hyperautomation and autonomous finance — that will revolutionize management reporting and lead to more efficient, accurate, and insightful management reporting. As a result, organizations will make better-informed decisions and stay competitive in a rapidly evolving business landscape.