- This website uses cookies

- “The new normal” requires a change of plans

- The Office of Finance as the agent of change

- Sponsored success

- Resistance isn’t futile

- Five common myths about change management

- How to approach a change management initiative

- Creating a best practice change management structure

- How Jedox approaches change management

- Conclusion: Successful digital transformation starts with change management

“The new normal” requires a change of plans

Picture this: your organization is on the brink of a new era, where the future demands a transformative shift in your Enterprise Resource Planning (ERP) software. You must choose a system, decide when to implement it, and manage the change. For many businesses, this can feel like a high-stakes surgical procedure.

Best-in-class planning and performance management, also called Enterprise Performance Management (EPM) software, is a more straightforward implementation as compared to an ERP project. But it still requires a thoughtful approach—with the Office of Finance acting as a catalyst for change. Successful implementation of change requires careful planning, coordination, and execution across multiple departments and teams.

However, haphazard implementation comes with a high risk of failure. If not managed effectively, it can lead to data loss, poor performance, and employee dissatisfaction. Assuming that change is a basic truth in business, it’s not a matter of if but when and how.

Organizations must adapt to a rapidly shifting business environment to compete, succeed, and lead. The global economy, societal and political climates, regulations, and consumer behavior all influence that environment. However, digital transformation—such as AI, machine learning, hyperautomation, and other innovative technologies—has an outsized impact, compelling organizations to transform their operations.

In short, change is the new normal. Organizations that accept this truth can build resilience and better prepare for the future. Effective change management can be a transformative force for businesses—propelling them forward and strengthening client relationships. Still, for many large and small organizations, change is disruptive and can lead to unintended consequences and uncertainty.

A longstanding belief within business is that 70% of organizations fail to make changes as intended.1 Whether that figure is still accurate today, organizations need to realize that any change management process will be full of obstacles and uncertainties. This understanding can help them prepare for the challenges and unknowns ahead.

This white paper will explore how Finance leaders should think about:

Additionally, it will describe how Jedox supports digital transformation within organizations and include three case studies highlighting effective change management spanning years of sustained commitment from all stakeholders involved.

The Office of Finance as the agent of change

Today’s Finance department is uniquely positioned to play a pivotal role in many organizations’ growth. By becoming more involved across the organization and evolving as a strategic business partner, it’s at the heart of driving enterprise-wide transformation. Finance’s influence on strategic decisions, insights into financials, and oversight of data management and KPIs make it the key player in change management.

This role is partly due to its evolving responsibilities beyond traditional functions, such as financial planning and analysis (FP&A), controlling, and financial reporting. In many organizations, Finance now:

The modern Finance department has insight into every business unit and keeps an eye on new opportunities. It interconnects, harmonizes, and manages multiple systems—such as ERP, EPM, financial consolidation, customer relationship management (CRM), business intelligence, and data warehouses. At the same time, it collects, unifies, analyzes, and interprets large amounts of different internal and external data using tools such as FP&A software.

To deal with the increased workload and complexity, the Office of Finance needs to become more efficient and agile while promoting better cooperation across the company. This will make handling cost pressures easier—think capital, margins, and speed to value, such as internal rate of return, net present value, and return on investment. It will also help deal with workforce issues, such as talent recruitment and retention, the need for more diverse skillsets, a tightening labor market, retirement, and generational expectations.

Sponsored success

Like Finance, executive leadership is a driving force for change management. It sets the tone and direction for the entire organization, inspiring and establishing a vision for its future. Leaders shouldn’t be viewed as figureheads but as active and visible sponsors of change.

However, those who are inflexible, uninvolved, and uncommunicative will face more significant resistance to change—which is why so many initiatives fail. “People are people—carbon and water. As such, we resist change. It’s important to recognize that managing change is about upsetting people only at a rate that they can tolerate. It’s all about physics. For change there must be movement. With movement there is friction,” says David A. Shore, a strategic change management instructor at Harvard.1

In fact, research has shown that few employees actively understand and embrace their organization’s strategy, decisions, and efforts behind a change initiative. Lynn Kelley, author of Change Questions: A Playbook for Effective and Lasting Organizational Change, says that in any given change initiative, 20% of people are open to it, 60% are neutral, and 20% actively resist it. She shares: “The people who don’t want the change have the loudest voice.”2

Resistance isn’t futile

Change can be scary. It’s human nature to be skeptical, anxious, and uncertain about how it will impact one’s daily life. Many may not understand why a change is needed or how it could benefit them. Some may believe a change could result in a layoff or require them to learn a skillset to keep their jobs. Others may not trust their leaders.

Effective change management means engaging with all affected stakeholders, especially operational employees. It’s more than just assessing and addressing their needs, concerns, and related risks; it involves showing empathy, offering emotional safety, and conveying trust. As Shore says: “When change initiatives fail (and they do so more often than not) they rarely fail on technical skills (hard skills), they fail on the people skills.” 3

Therefore, it’s important for Finance leaders to consider questions such as:

Five common myths about change management

Change may be the new normal, but embracing it is another matter. Organizations should approach every initiative clear-eyed about the goals and challenges they will face. They must understand what change management is and isn’t; this ensures they won’t be weighed down by misconceptions and myths that could unnecessarily alter—and hobble—their approach. Organizations should be aware of these five myths.

How to approach a change management initiative

Understanding stakeholder dynamics

Have you ever noticed a separate swim lane for project management in project plans? It’s because managing projects is a unique skill, different from the technical skills needed to complete the work.

A big part of this skill is predicting and handling change. When embarking on a change management initiative, it’s essential to identify the key stakeholders adopting the new technology, procedures, or operations. This could include, for example, migrating to a new system, implementing what the Gartner® analyst firm describes as Financial Planning Software (FPS), or implementing business process improvements.

It’s crucial to involve these key individuals or groups in the project as early as possible since the change will impact them the most. This means empathizing with their current situation and pain points, understanding and addressing their resistance to change, and gaining their approval and acceptance. With such diverse experiences and perspectives, stakeholders’ active contributions will enhance a project’s success.

1. Identify stakeholders: Based on their level of interest and influence, stakeholders include employees ranging from Finance and IT teams to upper management, clients and customers, contractors, suppliers, regulatory bodies, and other end users, such as members of the C-suite.

2. Assess needs: Ignoring stakeholders’ attitudes towards and influence over a change management initiative would be a mistake. Systematically assessing their fears, concerns, goals, interests, expectations, and priorities is paramount to advancing the initiative. For example, this should include training that they may need once the initiative is completed.

3. Communicate constantly: Clear, prompt and effective communication with stakeholders is pivotal for conveying information about the reasoning behind a change, its implications, and expected benefits. It’s also necessary to create a two-way exchange. Emails or videos, face-to-face meetings, forums, impact assessments, and other methods can help provide information and document changes.

4. Allocate resources: After assessing stakeholders’ concerns, impact, position, and importance, organizations can better decide where to distribute resources. This allows them to focus on areas which need more attention and extract the best value from the initiative.

5. Ask for input: Involve stakeholders in the decision-making process. Without their participation, support, and approval of changes, the project’s success will be much lower. To understand their concerns and preferences, there are several ways to gain feedback: interviews, surveys, workshops, and focus groups. When their feedback is considered, stakeholders are more likely to buy into the initiative and disagreements are more easily resolved.

6. Monitor engagement: It’s vital to track the initiative’s progress through consistent communication and exchange with evolving stakeholders’ needs. Leaders should also identify areas for improvement and adapt their strategies and tactics accordingly.

Creating a best practice change management structure

Organizations should establish a governance structure to effectively oversee, orchestrate, optimize, and advance a change management initiative. This structure should ideally maximize stakeholder participation while addressing needs, balancing workloads, and prioritizing resources.

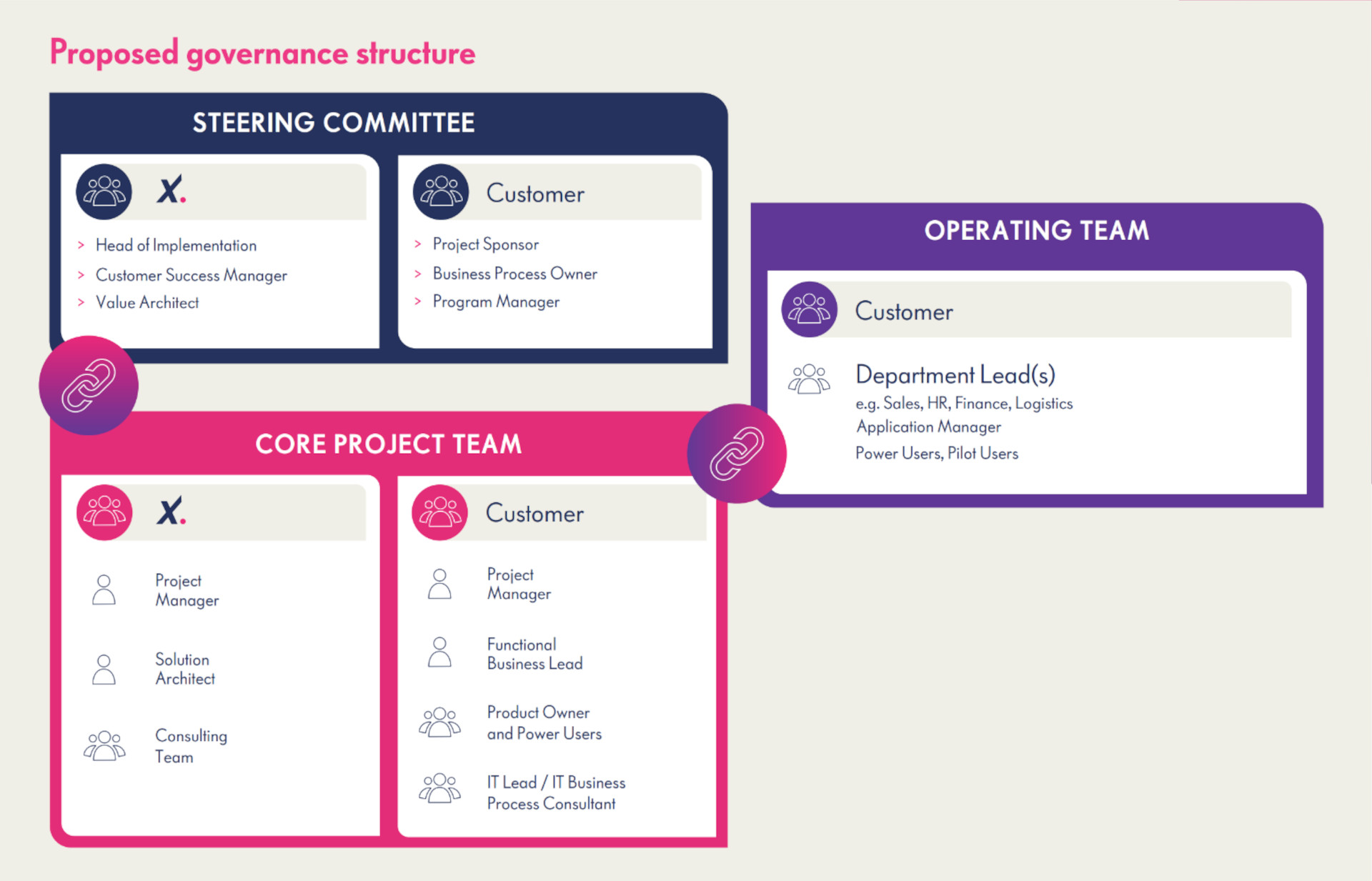

Jedox believes that fostering a solid relationship with customers builds trust when embarking on change management initiatives. This collaboration should be reflected in a governing structure, which would depend on the customer’s level of independence and self-sufficiency. This structure involves three broad components to guide and support the change: a steering committee, a core project team, and an operating team.

Steering committee

This governing body includes key stakeholders and provides executive support to ensure projects (and their budgets) stay on track, mitigate risks, and achieve their goals. In this committee, Jedox typically provides a head of implementation, a customer success manager, and a value architect—along with a project sponsor, business process owner, and program manager from the customer’s side.

Core project team

This team, made up of managers and experts, leads a change and handles the day-to-day oversight of an initiative. This includes monitoring the progress of key deliverables and making course corrections. In a core project team, Jedox provides a project manager, a solution architect, and a consulting team. At the same time, the customer provides a project manager, functional business leader, product owner and power users, and an IT lead or IT business process consultant.

1. Project manager: Regardless of the organization’s size or the initiative’s scope, a dedicated project manager should be appointed to oversee the transformation. A project manager’s duties are to ensure that the initiative is on budget, on time, meets technical requirements, and achieves desired goals. A project manager acts like a central hub, following a strategy, integrating the work among stakeholders, communicating relevant information to advance the initiative, and adjusting the plan.

2. Operating team: This team consists of department leads from Finance, HR, Logistics, and Sales, as well as application managers, pilot users, and power users.

Developing change management strategies

Successfully managing a transformation requires leadership, expertise, and substantial resources. It requires alignment and collaboration among the executive sponsors, project managers, and stakeholders to progress from vision to strategy to implementation to adoption to evaluation. A change management strategy is vital because it governs all parts of a transformation.

In essence, the most effective strategy manages and minimizes resistance while driving adoption. It’s the responsibility of leadership and project managers to build a case for the change management initiative—emphasizing benefits, communicating clearly, and building trust. A holistic strategy needs to:

Emphasize benefits

Any change initiative may be met with resistance. One way to mitigate the risk is to present and explain the various benefits of a transformation beyond cost savings. For instance, organizations should stress that a potential change would enhance productivity, streamline processes, improve accuracy, enable them to conduct more analysis, and strengthen decision-making. As a result, this could lead to greater job satisfaction and less stress.

Offer incentives

While outlining benefits is an excellent strategy to reduce resistance, another one is to offer incentives such as bonuses, promotions, or recognition. This helps incentivize stakeholders to embrace the transformation and lets them know that the organization prioritizes their involvement and endorsement.

Communicate clearly

Interactive, transparent, and consistent communication is essential for effective change. It’s imperative to involve stakeholders early in an initiative, assess and address their worries, create a multi-channel approach—both digital and traditional—to share information and gain feedback during a project. This helps to develop collaborative relationships between management and various stakeholders. Messages may need to be tailored for different stakeholders, considering their needs, interests, and cultural/social backgrounds. Appreciation for employees’ efforts and cooperation also should be part of that strategy.

Provide training

Any change initiative will require training and development for stakeholders involved in the new process, technological tool, or system. Organizations should plan and provide sufficient training to ensure employees understand, adapt, and transition smoothly to the new system. Provided early on, training will help employees understand benefits, reduce resistance, increase engagement, create positivity, and align with goals and objectives.

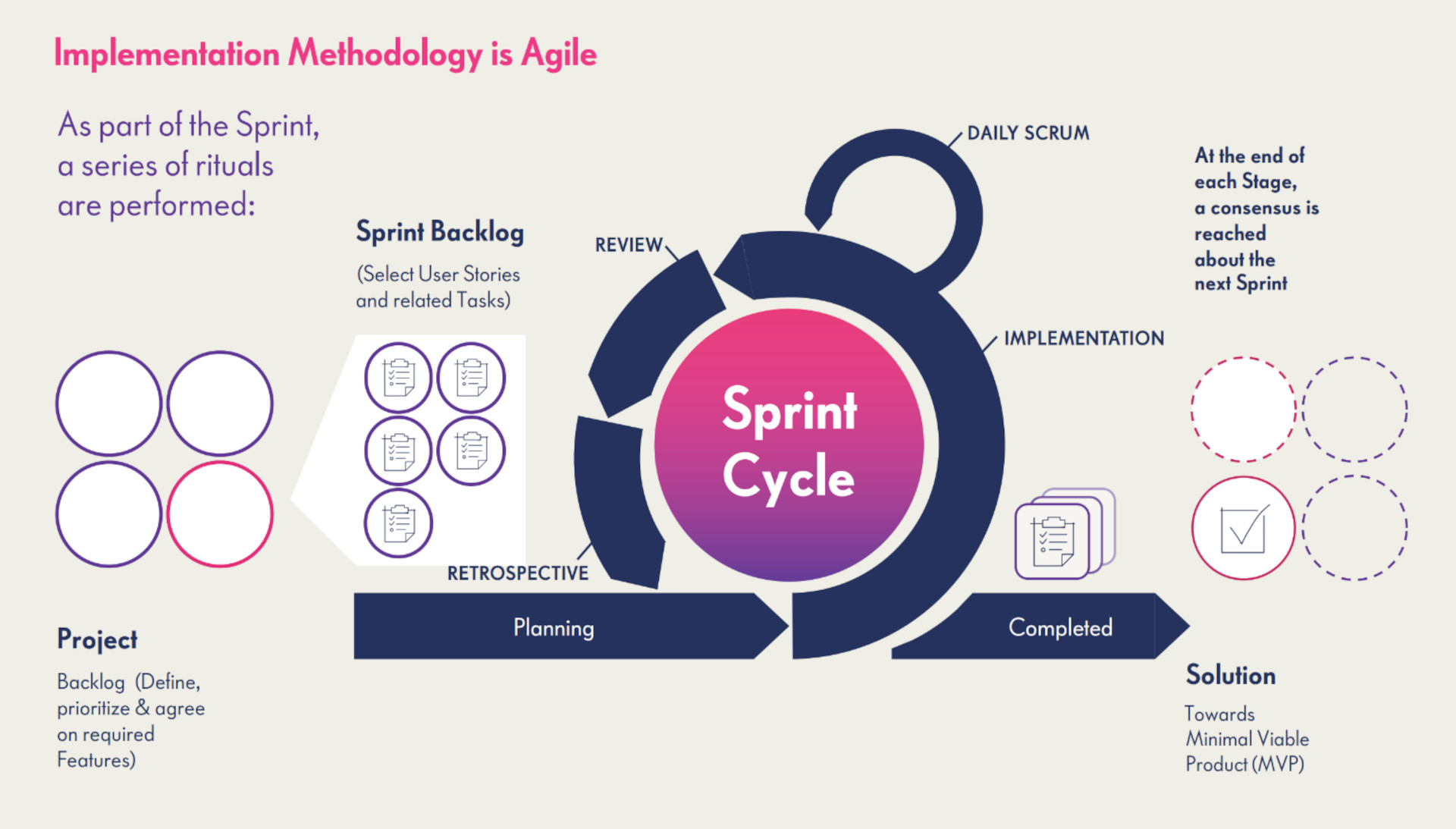

How Jedox approaches change management

Organizations are constantly looking to make planning, budgeting, and forecasting more efficient and effective. Jedox understands that it’s difficult to implement new financial technologies, systems, and processes when dealing with an entrenched culture. It takes a collaborative approach to plan and shape the future of any organization.

Jedox takes a deliberate, customer-centric approach, incorporating the above principles and practices to integrate technologies and processes that achieve maximum integration with minimal disruption. This includes collaborating with clients to help design, develop, and deploy change initiatives.

Focus on risk

Jedox specifically focuses on assessing risk to ensure that an initiative achieves success. It’s best to identify risks early on, address them proactively, and monitor them throughout implementation. For instance, the top three risks in Jedox initiatives are: data quality, availability, and migration; user involvement and their level of innovation; and an organization’s overall IT maturity and steadiness.

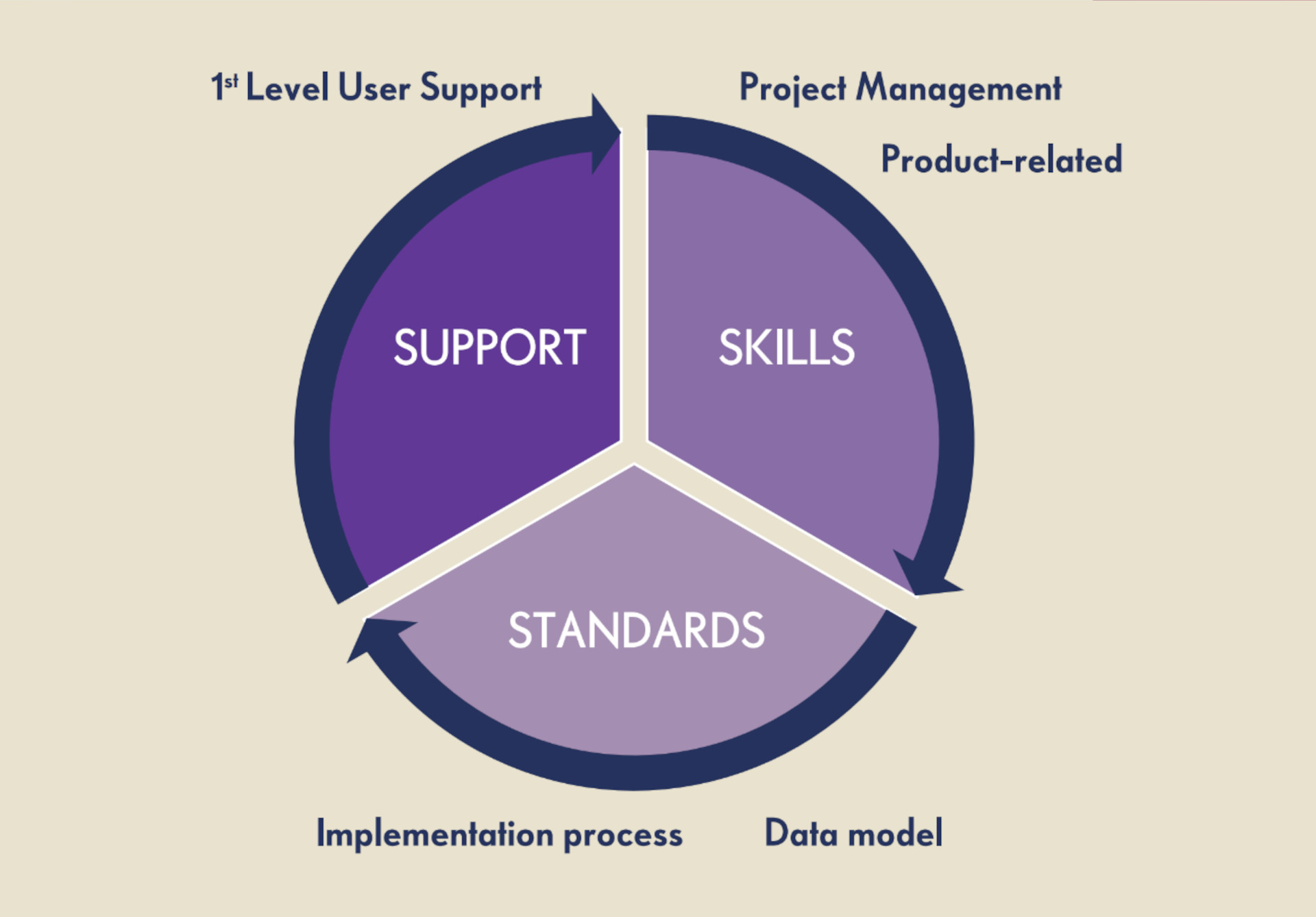

Establish centers of excellence

Depending on the complexity of a transformation and the size of an organization, Jedox employs a center of excellence—or competence center—model. The idea is to provide leadership, guidance, and monitoring to ensure the transformation is effectively implemented and executed with the right expertise and proper resources. Jedox has developed centralized, decentralized, and hybrid approaches within these models.

A centralized approach would typically be used for an initial setup, as it includes more rigid management styles and primary lines of business such as Finance or Sales. Advantages include:

There are some disadvantages to a centralized approach, including reduced responsiveness and inflexibility for specific requirements; less motivation, engagement, and creativity among stakeholders; and a higher risk of resistance and bureaucracy.

In a decentralized approach, the competency centers are spread across an organization and closer to user groups. This approach works best when initiatives involve multiple business models and departmental solutions. Advantages include:

Disadvantages include less control, exchange, and coordination of resources, potential duplication of work, hidden conflicts of interest, and less governance and enforcement of standards and procedures.

In a hybrid approach, both centralized and decentralized models are used. This is usually used when an organization develops quickly and needs to implement solutions in parallel. The hybrid approach centralizes, for example, corporate design, core metadata structures, and templates—while decentralized centers support different user groups. The advantage of a hybrid center includes:

However, some disadvantages exist, such as the delicate balance of authority, as well as less governance and enforcement of standards and procedures.

Jedox in action

Jedox has deep experience helping organizations successfully implement their initiatives using a change management program designed for them and through a collaborative effort. Below we’ll explore three case studies exemplifying our work in game-changing transformations that ensured organizations stayed at the forefront of their industries.

Conclusion: Successful digital transformation starts with change management

Leading change management is a critical and essential part of digital transformation, but it’s challenging. There’s no simple formula. It requires commitment, planning, and effort from all stakeholders—as well as alignment, resilience, and strategy. Executives and employees should enter a change initiative knowing there will be obstacles and resistance to overcome, but nothing so great that it can’t be addressed by listening and addressing those concerns.

If done right, change management becomes part of an organization’s core competency and mindset. In doing so, employees’ beliefs and attitudes are reframed to be more forward-looking and capable of addressing future transformations rather than feeling skeptical, anxious, and uncertain.

Change management starts as a conversation among executives, managers, and employees about improving themselves and their organization. The point is to make this conversation continuous, evolving, open, and introspective. By adopting this way of thinking, organizations can create a new culture that’s more customer-centric and communicative—with a focus on building relationships and trust. This creates a foundation for seeking new opportunities, coping with dynamic market shifts, and staying on top of trends—especially in this era of digital transformation.

References

1https://www.linkedin.com/pulse/70-organisational-change-failure-rate-still-living-myth-berggreen/

2https://www.peoplemanagement.co.uk/article/1869370/cipd-change-management-conference-organisational-change-more-likely-fail-succeed-%E2%80%93-so-hr-prevent-failure

3https://professional.dce.harvard.edu/blog/7-reasons-why-change-management-strategies-fail-and-how-to-avoid-them