- Foreword

- The 10 core principles of planning and forecasting

- The 10 core principles

- 1. Why planning should always be aligned with strategy

- 2. Why documenting your assumptions is the most important part of planning

- 3. Without an effective feedback loop your plan will fail

- 4. Why you should blow up your budget process

- 5. Accuracy is an outcome of good planning

- 6. The planning department is not the whole company – but the whole company better be planning!

- 7. A simple plan is the best way to achieve your target

- 8. Re-forecasting your finances should never take more than a week

- 9. Never plan without preparing multiple scenarios

- 10. Great planners always plan with contingencies

- How to use The Planning and Forecasting Blueprint

- Where now?

Foreword

Name a corporate process you think is the biggest time waster leading to little to no impact? I bet many of you would name the budgeting process or more widely speaking planning and forecasting. We spend insane amounts of time on the process yet every time we’re done it’s already outdated! There must be a better way…

To find a better way, I asked our community of finance, accounting, and FP&A professionals for their insights. The result? “The Planning and Forecasting Blueprint”! It consists of ten principles such as “Always align your plan to your strategy” and “Always thoroughly document your assumptions”.

It is meant as a guide for all you planners out there to do things differently. It contains simple, practical, and actionable steps to change your planning and forecasting process. Not least it is meant to nudge you in the direction of creating a more collaborative process that expands beyond the finance silo.

In a world of constant change the planning and forecasting process is only gaining more importance yet if we keep responding to this in the ways of old, we’ll soon have a nightmare on our hands. Building a new process based on these ten principles will give your company a competitive advantage over those who refuse to change. Are YOU ready to change?

Anders Liu-Lindberg

Business Partnering Institute

The 10 core principles of planning and forecasting

Planning and forecasting may feel as if they differ from business to business, but the underlying principles never change. It’s almost as if there are rules set in stone for successful planning!

This got us thinking and, with help from the community over the past few months, we put together ten not just rules but principles to plan by. We are now taking the next step to write the “Planning & Forecasting Blueprint.”

Why do we need a “planning and forecasting blueprint?” Because FP&A professionals are always striving to improve and share best practices, we know the challenges that come with effective decision making support in fast-moving business environments.

Sometimes it’s easy to take your eyes off the simple rules and get swamped by the complexities of your specific organization. But underneath the routines and the long-established habits you will always find sound principles and expectations. By re-focusing on the reasons why you act as you do in your role, you become more effective and add greater value to the business.

The 10 core principles

These are the collected 10 principles to take planning and forecasting to the next level…

- 1

Always align your plan to your strategy

- 2Always thoroughly document your assumptions

- 3Maintain a robust feedback loop within your planning process

- 4Do not combine processes; setting targets, forecasting, and allocating resources are separate

- 5Know that improved accuracy is an outcome of planning

- 6Planning should be collaborative and cross-functional

- 7Strive for simplicity in your planning and forecasting processes

- 8Aim to be able to re-forecast your business within a week

- 9Always consider multiple scenarios

- 10Leave room for flexibility; don’t commit all of your resources at once

How can we put these into practice?

In this eBook, we’ll dig into the reasoning behind the inclusion of each principle and its importance in building a world-class planning and forecasting process. We will look at the different ways to refocus on these simple rules and ensure that they are a conscious part of the regular process of planning and forecasting.

We’ll also consider some of the practical steps you can take, including the smart use of new technologies to support the planning and forecasting process and subtle changes to decision-making KPIs that can transform the value delivered to the business.

1. Why planning should always be aligned with strategy

The first principle of the Planning and Forecasting Blueprint is: “Always align your plan to your strategy.” This seems obvious, but it is harder than it might appear, as FP&A professionals have discovered through the years.

Every organization must have a goal. If the business has nothing to aim for then there is a fundamental problem that FP&A can’t solve. Once a goal is established – the top-level vision and mission – this must be translated into a clearly articulated vision of what success looks like, with many different smaller goals and milestones.

What activities does this successful business undertake, and how does it get from here to there? The strategy will still be a broad brush, but this is where FP&A comes in. What resources does the business need to make its vision a reality? What could change along the way?

Planning and forecasting go hand in hand with strategy. It quantifies the resources needed at each stage of the intended strategic development so that they can be in place to help the business grow. It provides clear indicators of performance for those strategic milestones. It offers carefully considered options to reach the same goal in a different way, responding to market conditions with the goal always in mind.

Sounds simple, right? So why does this not happen every time? Why is this principle at the forefront when we consider good planning and forecasting?

The challenge of linking plans and strategy

There are several things that can go wrong in the mission to attach coherent plans to a business vision. Communication is high on the list, along with company culture and the standing of the finance function.

Communication is the glue that holds plans and strategy together. Every operational unit strives to reach the organization’s goal, but without good communication across all functions (not just between FP&A and the C-suite) they will all pull in different directions.

The sales funnel may be full, but if production is under-resourced for a particular range of goods there are problems. Does the optimum product mix align with market needs? Both functions believe they are doing their best to fulfill the company’s strategic goals, but without good communication and constant feedback in planning and resourcing for the best joint strategy, neither will prevail.

How does the company view the finance department?

A mature FP&A function has a seat at the highest table, an overview of the whole business, and the respect of its peers. An embryonic finance function that has not yet achieved the right level of business partnering may be siloed and focused on recording, reporting and processing spreadsheets.

FP&A has a pivotal role to play in aligning strategy and plans in a holistic way and needs the trust of the C-suite to carry this out.

How can we start to overcome some of these challenges?

It all starts with effective business partnering. Successful enterprises have a lot of moving parts and FP&A can balance the whole and support the C-suite’s plans. This is important for businesses of any size in the current environment of constant change but is particularly critical for rapidly growing and evolving enterprises.

Whether growth is organic or by acquisition, FP&A is central to ensuring that the resources available line up with the strategic goals of the business. When external factors conspire to derail the plans, FP&A is ready with a new route that aligns with the overall strategy.

If the plans don’t align with the strategy, look to the state of business partnering. Build the relationships that matter, focus on understanding each of the moving parts, and develop mutual trust and respect to deliver the best strategic plans for the business.

2. Why documenting your assumptions is the most important part of planning

All good plans start with a hypothesis asking, “What would have to be true for our plan to be a good plan?” The strategy and goals against which the plans are created need to be translated into actual resources, targets and actions for shorter timeframes, and the assumptions made to start qualifying and quantifying these are not the preamble to planning, but its foundations.

Hypothesis-driven planning is common in the world of software development. It allows companies to experiment with different viable options to deliver what the customer needs, adjusting assumptions with each feedback cycle. This agility prevents the all-too-notorious scenario of a large project being delivered after years of work and not meeting the requirements that evolved between commissioning and completion.

What if your carefully constructed budget fell into this trap? It’s not unknown for companies to push forward with the Big Plan without regularly reviewing the assumptions that underpin it. If the business environment changes, assumptions may no longer be valid, and these huge vessels take time to change course. We want our organizations to turn like a speedboat, pivot in the face of change, and take advantage of new opportunities.

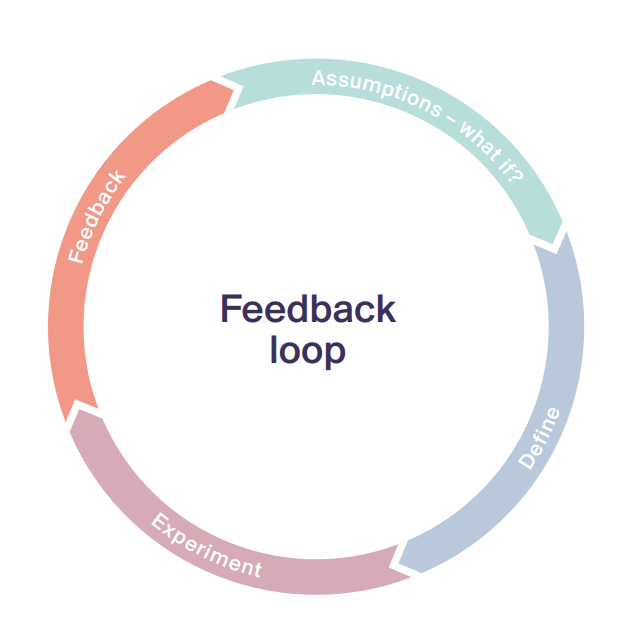

Championing hypothesis-driven planning

This process runs through a classic feedback loop, but rather than focusing on the numbers, it assesses the effectiveness of the assumptions that gave us the numbers.

Start by looking beyond your forecasts and consider what made you select particular variables for your sensitivity analysis, your “What if” scenarios. Now turn the process on its head for the next round of planning and actively define your assumptions before running any numbers.

First, look at what conditions would have to be true for the plan to be a good plan. In software development, the goal may be to have more users download an app. The company’s own market research might indicate that users like to be able to choose the background color of their app. The hypothesis is that introducing this feature will make the software more attractive and more likely to be purchased.

Next, it’s time to experiment, to isolate and test the assumption as the variable that it is. Document the assumption so that you can show that this plan has been tested. Plan for the resources that are needed and the action that the company will take. Define the success criteria – after a month, a quarter, or a year, what uplift in sales or reduction in costs will show that this plan is good?

Track and follow up on your assumptions

When the results are in, it’s time to review and give feedback not only on the classic variances, but on the underlying hypothesis that you tested.

The classic variances are important, of course – there is a need to understand how effectively resources have been used and managed – but you need to look back at the experiment and decide whether your hypothesis should be accepted, continuing along the same path towards strategic goals, or rejected, and a new hypothesis developed.

Documenting this entire end-to-end process is vital. We want to emulate success – and we have no wish to repeat failures. Particularly where hypotheses are intuitive, there is the danger of falling back on the same misconception, or worse, losing track of the one thing that made this plan a good plan.

3. Without an effective feedback loop your plan will fail

You have a plan, and you know it’s a good plan. The future is bright, and the strategic milestones of business growth are glittering on the horizon. But what happens when you find the path blocked and the milestones out of sight? If there is no way to move past the blockage the plan has failed. Can you find a new route to the prize – and should you have been aware of the impending change to the business environment before grinding to a halt?

In the same way that good satellite navigation crowdsources feedback to constantly update the route of your journey, a good plan will take feedback from the business operating environment and constantly evolve to nudge you in the right direction. Instead of careering ahead with the original plan, coming up against an intractable challenge, and having to backtrack and contract, an effective feedback loop keeps the milestones in sight.

The plan has already been created using feedback on your well-documented assumptions (of course!), so why should the feedback process stop when the journey is underway? Planning is not a single moment in time. It’s continuous, a living document that uses a strong feedback loop to stay on track.

“Remember, the goal of the business is not to execute the plan as given – the goal is to reach those milestones.”

How do you best create a feedback loop?

An effective feedback loop is based on measurable indicators, draws from different sources, and is acted upon.

What kind of indicators can keep the business on track? The Balanced Scorecard suggests a heady mix of measurements around internal business processes, the development of the workforce, financial performance, customer acquisition and satisfaction, and technology, sustainability, and supply chain indicators. There is a lot to unpack here. Using Artificial Intelligence to analyze data and reveal underlying trends can help FP&A professionals adjust the plan as soon as a need is identified.

Acting on that information is vital. Knowing that conditions have changed yet carrying on in the hope that the original plan will prevail is worse than having no feedback loop at all. A great example of this can be seen among head vs. heart investors in everything from stocks and shares to cryptocurrencies.

Market data and wider economic data are readily available, and the feedback loop is whirring all the time. When there’s an indicator of a market crash, “head” investors have an action point, a stop-loss value at which they will sell their holdings to stop further losses. “Heart” investors may ride the lows, staying dormant until the market rises again and their old plan is relevant again. Can a business afford to stop and wait for reality to match the plan?

The impact of an effective feedback loop

Agility in the face of change has been thrown into sharp focus by the market disruption of COVID-19, the supply chain challenges arising from the war in Ukraine, indicators of impending recession, and the drive towards sustainability.

Deloitte reported in March 2022 on how some US companies, particularly semiconductor producers, used their feedback loops to minimize supply chain disasters. Anticipating a potential invasion months before Russian forces attacked Ukraine, they stockpiled essential materials in response to early feedback and planning at the US Department of the Interior. However, those companies that were slow to react to this data that was already out in the public domain found themselves with idle production lines.

In a longer-term example, listening to early feedback from investors helped Starbucks to establish a strong plan and culture of sustainability through its supply chain before this was common in the industry.

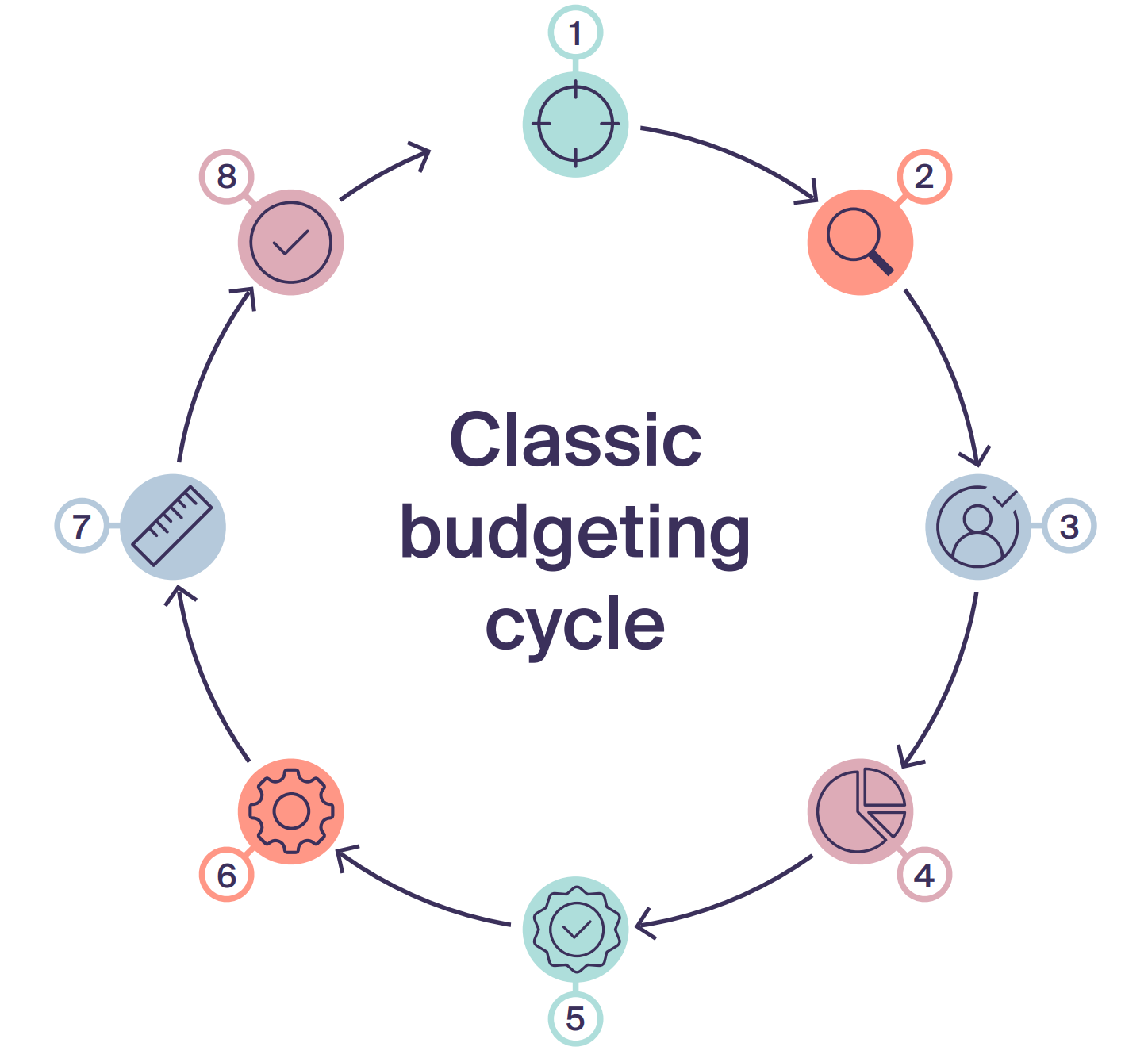

4. Why you should blow up your budget process

Budget processes typically try to achieve too much. Blowing up the picture – zooming and expanding your view and dividing it into sections – gives space to plan effectively.

There are so many different facets of planning that a single approach doesn’t deliver the goods. It simply serves to obscure the finer details, particularly of non-financial measures, from both budget setters and the users of the plan, and crucially from subsequent review and reaction throughout the business. The budget process sets the organization’s travel itinerary from its position now to its strategic milestones and ultimate goals. If this is to be an agile and effective plan, it needs to cover three distinct phases. Where is the company going, what is the best way to get there (and what are the alternative routes), and what is required to make the journey? These three phases of planning differ in their focus and technique, although they all combine for success. Splitting the budget process to address each separately offers the opportunity to test and document the logic behind the translation of a vision to specific targets, the underlying assumptions of forecasting, and the availability of resources. It enables the creation of meaningful Key Performance Indicators (KPIs). It also helps in the future, as the plans play out, to understand exactly where to pivot and shift in the face of change.

Wheels within wheels

The classic budgeting cycle runs something like this:

- 1Define objectives

- 2Check resources

- 3Assign responsibility

- 4Produce budget accounts

- 5Management approval

- 6Implementation

- 7Measurement

- 8Review and redefine objectives…

If the laws of geometry permit such a statement, this is a very linear wheel. There are strong arguments for wheels within wheels. Three strands of clear thinking will feed into the overall budget that is eventually approved by management. Three strands of measurement will assess the effectiveness of the different phases of planning independently.

This approach breeds agility, the ability to make rapid and granular changes when the need arises to stay in pursuit of the ultimate corporate goal. It also helps with the cohesiveness of corporate culture.

How?

Blown-up budgeting paints a clearer picture for different operating units and successive layers of budget responsibility. Blending target setting, forecasting and resource allocation can result in a skewed focus on one aspect (most likely financial metrics) when judging the performance of a cost center, and ineffective delegation of responsibility.

Ultimately, the goal of planning is to know where you are going, steer effectively, and have the resources available for a smooth journey. Bringing a convoy of cost centers along requires each one to have the same understanding of the task and their part in the whole. Giving equal attention to all three areas can help individual units stay on course and flag barriers on the horizon or challenges with resources in a timely and organized fashion.

A clearer picture

This principle in the Planning and Forecasting Blueprint may feel like it’s adding complexity to the budget wheel, but the reverse is true.

We already have the tools and the skills to do all three things in the pursuit of good planning, but the habit of rolling everything together is a false dichotomy.

Blowing up the budget process saves time, money, and possibly the cohesion and success of the organization itself in the long term.

5. Accuracy is an outcome of good planning

Does this feel like a contradiction? We strive for the best in forecasting, so why do our 10 Core Principles of Planning suggest that accuracy is not something we should aim for? After all, we gather details from every operating unit, dig deep into data, and test our assumptions to craft complex yet flexible plans. Surely the business is relying on our accuracy to reach its goals!

And there, laid bare, is the answer. Accuracy lies in the execution of the planning process, not in the plan itself. A budget is not an attempt to predict the future. It is not delivered using a crystal ball. It is a highly detailed navigation and operations manual for a journey into the unknown.

The forecast supports the business as it travels through the choppy seas of reality with eyes fixed on the horizon. The route will deviate as the business changes course to avoid storms and squalls or to take advantage of friendly currents that accelerate the journey. There is no point pushing through a destructive gale or ignoring opportunities just to stay on a course that was dictated before the conditions could be known.

Reinforcing the purpose of forecasting

Blind accuracy of forecasting is sometimes seized upon by inexperienced managers who shoot the messenger if reality deviates from the plan. This generally shows that they don’t understand the purpose of forecasting. Whose problem is this? It’s ours.

We have a responsibility to the business to communicate the power and the limitations of forecasting, ensuring that the forecast is treated as the navigation aid it is, rather than just a lifebelt. Focusing on ‘accuracy’ gives the business a false sense of security as they cling on through the storms, whereas what they need is clarity on different ways to reach goals that lie on the horizon.

But how is management to assess the forecast and the work of FP&A? Accuracy is a crude measure that discounts the impact of operational performance and economic conditions. A historical forecast’s correlation with present reality is not a suitable measure of planning performance. What should we focus on instead?

How can forecasting be measured?

Effective planning enables a business to be agile and react to changing conditions, whether the storms come from outside or within. What are the elements of forecasting that can themselves be measured and assessed? What do we need to know to improve both the process and the output? Here are some suggestions.

6. The planning department is not the whole company – but the whole company better be planning!

If you had no say in planning or forecasting, would you feel comfortable that your concerns were covered?

However diligent, a plan formulated by someone else on your behalf will dictate your activity and allocate resources according to their perception of your priorities and may be biased towards their own preferences. Even if they get it right, you may harbor a little resentment that you weren’t involved in the planning. This doesn’t make for a relaxing holiday after all.

This is why, in business, a plan made entirely by Finance will always fail.

Having responsibility for planning and analysis does not mean that the whole forecasting process should be siloed within Finance. This is a trap that both finance and the C-Suite need to avoid. It is perfectly possible to craft a detailed budget and define plausible Key Performance Indicators based on a wealth of historical data and goals for the future. It may be the fastest way to get a set of good-looking numbers to the Board. But a plan is a living document that impacts the whole company, and everyone must be part of it for it to succeed.

Leading an inclusive planning process

The label of planning and analysis indicates not an isolated function but a skill to be used in the service of the whole company. To succeed, every part of the business, every operational unit, needs the help of Finance.

Planning is the role of finance in the same way that managing computers and networks is the role of IT. Both departments are highly skilled and relied upon to keep the business running. We interact with every function to ensure that they have the resources and knowledge to perform to the best of their ability.

Our responsibility is to understand and reflect their true preferences for the journey that the organization is taking, without bias. We also need to push back, challenge and resolve differences, helping them to understand and adapt if a preferred course of action is not likely to contribute to the overall vision.

Finance is the linchpin of an inclusive and cross functional planning process. We are perfectly placed to see the interweaving of each operational unit in the collective efforts to achieve corporate goals. Every action taken in the business passes through finance as transactions are processed and the impact on the bottom line and business value is revealed. Our cross-functional colleagues need our unique skills to analyze activity, test assumptions, and refine forecasts and plans.

In short, finance doesn’t act in isolation. Let’s sketch out a typical collaborative planning process.

The whole company better be planning!

What are the steps to success? Here are a few suggestions.

7. A simple plan is the best way to achieve your target

“Always aim for simplicity.” How can this principle be put into practice when organizations have so many moving parts and complexity is baked into the planning and forecasting process?

It’s not as difficult as it sounds. Simplicity is the natural outcome when planners avoid blending target setting, forecasting, resource allocation, and recognize that accuracy is not an important goal. Although the complexity of most organizations is undeniable, a complex process is prone to error, and a complex plan risks different stakeholders picking and choosing their goals to simplify targets.

Academic research backs this up. A study of simple vs. complex forecasting (Green & Armstrong, 2015) found that simple forecasts are either as reliable or significantly more reliable than complex forecasts, and that complexity can increase forecast error significantly. The authors also suggest that the main, dubious, benefits of complex forecasts are to hand decision makers the numbers they want to see, and to satisfy clients who are ‘reassured by incomprehensibility.’

Simplicity is fundamental to successful planning and forecasting. It reduces error, confusion, and risk. It strengthens the underlying assumptions. It improves scrutiny, as those who approve the plan understand what they are reading, rather than rubber-stamping the headline figures for ease. It improves trust, as everyone involved can see where the forecast comes from. Simple plans also make it easier for the business to see key milestones clearly and react to changing circumstances.

What does a simple plan need?

Communication goes both ways. Explain effectively how the planning process works, why particular information is needed, what the forecasting models are doing, and what the final plan means. Communication is not a one-way process, and it’s important to check that the detail has been understood.

Reaping the rewards of simplicity

Quite apart from the reliability and ease of management of forecasting processes and plans, simplicity helps to build a collaborative cross functional culture for effective planning and goal setting.

One of the most significant cultural outcomes of simplifying the process and the plan is trust in the forecast. Every function can see where it fits in the overall journey and how its performance interacts with, and impacts others.

In practice, what does this look like? It could be a sales force properly targeted and rewarded for bringing in the right mix of orders to optimize production and use scarce resources effectively. Simplicity removes any ambiguity about why a particular target has been set. It could be an individual function having the confidence to flag a warning, knowing that their input is trusted, and changes can be made to avoid disaster. It could be a whole company pivoting together in the face of new opportunities and threats. In a time where change is the only constant, this is the only way forward.

8. Re-forecasting your finances should never take more than a week

A week? The gasps around the internet are almost audible. Back in the good old days of Lotus123 and pocket calculators, it wasn’t uncommon to clock up double the normal working hours for a whole month at budget time. The idea of re-casting the figures in a week was a pipe dream. But now, it’s reality – or at least, it should be.

We are working in a world where the only constant is change. Our forecasts must keep pace with the economic and social conditions within which the business operates. That includes not only having stress-tested contingencies in place for the edge cases that might come to pass, but also the ability to react quickly when the unexpected happens. We’ve had a lot of that to deal with in the past few years, and a rapid and confident response to change equals survival. Speed, though, is not the same as haste.

Speed is the performance of a well-oiled forecasting machine taking evasive action to get past a blockage in the road ahead and stay on track. We are relying on a good driver – or rather, all the drivers that underpin our forecast models.

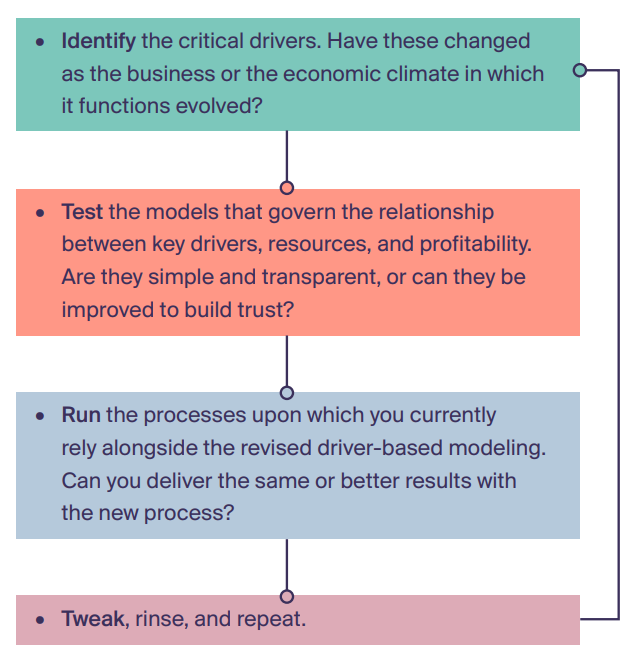

Drivers for speed

We build our forecasting model to reflect the activities of each operating unit. When the activities must change, our forecast changes, too. In complex organizations with many contributing units and multiple budget iterations, it’s easy to get lost in the headline financials. In the face of a Black Swan event, starting from the numbers at the top will bring the whole enterprise to a grinding halt as it tries to find a way around the problem.

Never lose sight of the drivers that lie beneath those headline numbers. Of course, it’s essential to choose the right drivers of activity, and to model their relationship to resources and output accurately, but once your assumptions have been tested then flexing activity levels to reflect a newly achievable reality will ripple through the whole forecast.

Avoiding complexity in forecasting and not worrying about perfect accuracy, as suggested in principles 5 and 7, will also stand you in good stead. When the model is simple then there is greater trust in the output. It doesn’t have to be perfect, but workable and comprehensible.

With confidence in the forecast outcomes of new activity levels, the rest of your week can be spent on the things that matter like building in new opportunities that have been exposed, identifying areas of concern, and testing new assumptions for future flexibility.

Steps to rapid re-forecasting

Have you already switched up your re-forecasting to guide the business through the uncertain times ahead?

How quickly can you confidently re-forecast when life throws a spanner in the works? If there’s room for improvement, it’s never too late to revisit your models and processes.

“The world is not going to slow down any time soon. We are long past the days of month-long late nights and budgets set in stone. Businesses that embrace rapid re-forecasting are ready for whatever the world throws at them on their journey to success.”

9. Never plan without preparing multiple scenarios

Every start-up business goes through a stage of gazing in rapture at an Excel spreadsheet predicting riches beyond imagination and believing that, with honest hard work, the plan must come to pass.

This mindset can prevail long into the development of a business, especially when the early years come with a fair following wind. It’s not helped, either, by external stakeholders from early-stage investors to the stock exchange demanding a return on investment that matches the plan.

But we know the truth. That plan will never come true. Those precise activities will not generate that precise bottom line, however hard you work, trying to react and develop a new plan in real-time can spiral into disaster.

You need to start planning alternatives from the get-go, and that doesn’t mean a finger-in-the-air sensitivity analysis on the headline numbers to tick a box on the management to-do list.

How do you prepare multiple scenarios without losing focus on the ultimate direction of travel, and what happens when the real world delivers an unexpected kick in the balance sheet?

High/low vs. real alternatives

The simplest scenario planning, high/low, is the litmus paper of realism and robustness. The worst case is a test of survival. It throws into sharp focus the point at which the business fails. The best case is a test of resources. It highlights scarcity and impractical assumptions.

Of course, like the original plan, neither the best nor the worst-case scenarios are going to happen. They are tools for improvement. They give planners an opportunity to test their first-pass assumptions, to reflect on the original forecast and to identify the critical drivers and milestones that will make or break the company on its journey. It’s part of the planning feedback loop, the starting point for the creation of not only a better forecast but more realistic and actionable contingency plans.

Real alternative scenarios will emerge from what is learned here. That critical milestone will be your trigger to bring in investment in resources, for example, to maintain momentum. Those key drivers are the foundation of a nuanced set of high/low scenarios that enable you to adapt and pivot to stay on course.

Everything we have discussed so far in this eBook comes together in developing multiple scenarios. Simplicity, tested assumptions, clear processes, and an understanding that a forecast is a navigation manual not a lifebelt, are all critical.

What happens when reality diverges?

The world around us has a nasty habit of throwing curve balls. For every carefully considered future outcome, there are many more that could arise. The global economic and socio-political landscape is too complex to predict with accuracy. Sanctions, war, pandemics, supply chain disruption and the fracture of trading blocs were not in anyone’s forecasts just a few years ago.

Who knows what the next decade holds? There are many things that we cannot see until we know what they are. Dallenbach’s 1951 psychology experiment demonstrates this (no spoilers – check it out here). The picture makes no sense on first examination – but once you know what it is, you cannot unsee it. As soon as the image resolves itself, we know whether we have that scenario in the bag, or if we need a new plan.

Fortunately, the ten principles of planning and forecasting have prepared us for this moment. We’re ready to re-cast the figures, test new assumptions, plot our new course towards the horizon, and take full advantage of opportunities that we cannot yet imagine.

10. Great planners always plan with contingencies

We know that the plan is not going to happen. We know that the forecast is not going to be (and should not be) 100% accurate. We’re ready to adjust our course quickly and effectively in response to changing circumstances.

However, the prudent accountant mindset can drift towards simply managing any negative effects on business. But great planners also must be ready for the positives. The current course may be taking you steadily towards your goal without any real insurmountable barriers, but what do you do if a new course presents itself, an unexpected route to greater success?

If all the company’s resources are directed towards navigating the course that is set, it can be time consuming and expensive to bring on new resources or reshuffle existing ones, and the strategic opportunities will pass. And therein lies the difficult truth.

Allocating 100% of your resources is a losing strategy.

How do we plan for the new opportunities that are still unseen? It all comes down to resource liquidity

Resource liquidity for strategic success

No, not the usual kind of liquidity – well, not entirely. Resource liquidity is more than just having ready cash to invest.

It is a mindset and methodology that delivers a strong talent pipeline. It incentivizes managers to optimize their current resources ready for future growth. It deliberately gives staff the breathing space to make innovative leaps and reveal new opportunities, to cut through the impenetrable layers of Dallenbach’s Cow and bring future strategies into focus.

It may seem counterintuitive to leave resources unallocated or under-utilized in pursuit of the goal. But the forecast will never play out as you expect, and the enterprise does not stand still. Game-changing opportunities can come from anywhere, and you must be able to mobilize the talent, cash, and operational capacity to exploit them.

Will there be a shift in technology adoption that exposes a new market? Will the R&D team come up with the best idea since sliced bread? Can the latest branding catch the imagination of the consumer? These scenarios must be part of the plan, and resources must be ready to flow toward them when the opportunities present themselves.

Stay ahead of the competition

True resource liquidity gives the organization a significant competitive advantage. It enables a rapid response to changes and maximizes potential returns, accelerating the business toward its goal.

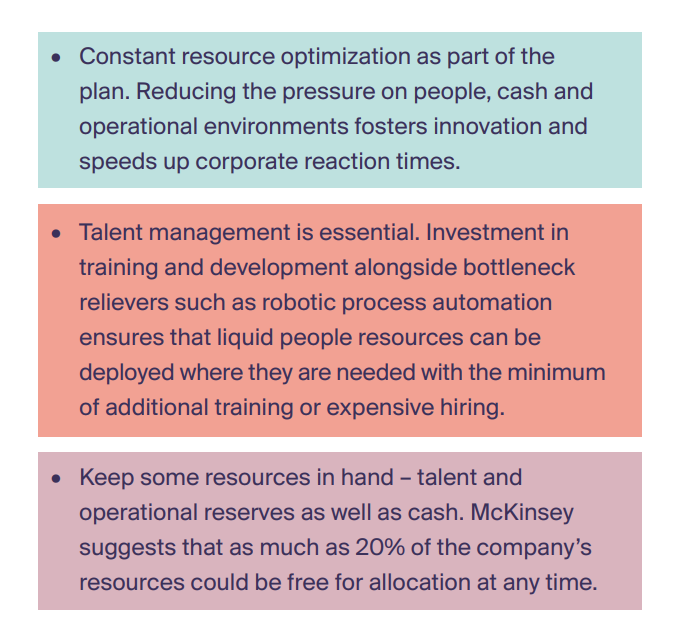

There are several key planning strategies to prepare for the best possible outcomes.

This isn’t an easy task. When McKinsey studied the market in 2018, less than a quarter of the firms they surveyed were engaging in any formal resource liquidity planning. Following the upheaval of the pandemic it’s likely that more companies understand the importance of being ready to grab opportunities, not just react to challenges.

How to use The Planning and Forecasting Blueprint

In a time where the only constant is change, we need to change up planning and forecasting. FP&A professionals are always striving to improve and to share best practice, and these ten principles are the top examples of best practice that were contributed by this fantastic community.

These concepts and guidelines are not prescriptive but a goal in themselves. In the same way that our work draws together a route map towards the business goal, these can be seen as milestones towards a new paradigm of planning and forecasting excellence.

Review the ten principles and consider where you are in relation to each of them. What is the first thing that you would improve in your own processes?

The 10 Core Principles of Planning

Where now?

What is the first thing that you want to change to bring one of these ten principles to life? What needs to be in place to do this?

Good communication, trust, mutual respect, and a seat earned at the decision-making table make the planning and forecasting process a collaborative, cross-functional and comprehensive process. In short, it all comes down to effective business partnering. By building relationships of trust and the foundation for responsiveness in the face of change, we can help steer our businesses to new heights of strategic success.