Why FP&A teams should adopt AI sooner rather than later: Two reasons

A Gartner survey conducted in 2023 showed that 61% of finance organizations were not currently using AI. While this number has likely improved, it shows a widespread hesitation about AI among finance leaders.

However, many finance departments would also like to take a more strategic seat at the table in their organizations and fear they’re falling behind. 62% of CFOs are seeing more demand for insights from financial data, but 53% worry that finance is too reactive (Accenture). Finance leaders want finance to be a strategic business partner, but instead, manual and tactical tasks keep the department stuck doing reactive bookkeeping.

Ironically, AI is predicted to be a key mover for finance teams who want to make this transition. Finance leaders should consider AI’s potential to free their teams for higher value work and transform their department into a strategic leader.

EY suggests that the dream of leading isn’t far off. FP&A teams are uniquely positioned to lead the organization, and they are poised to transform:

Reason 1: Be more accurate, faster

Finance teams are being pushed to get more operational and bring in more detailed data into their financial planning. But they face constraints like the time required to prep data, the limitations of spreadsheets, and lack of automation.

With AI’s help, finance teams can create a cohesive data stream from top to bottom. AI can rationalize huge amounts of data to bring in granular details that weren’t available before. For example, AI can surface nuances like, “Production line B is aging and will require maintenance this year,” a detail that would be hard to get from a high-level production plan but can be pulled via AI to make a plan more granular.

AI unlocks access to insights that FP&A teams have never had before. They can take these insights and proactively provide them to help guide the organization, ultimately gaining more trust and responsibility from the business.

Key takeaways:

“With AI, agile FP&A teams can uncover hidden patterns from structured and unstructured data and augment finance managers with new insights. This augmentation increases the speed and accuracy of forecasting and financial planning. As AI augments finance personnel, it helps them become more productive and frees up time to focus on knowledge and domain specific activities that deliver new value.”

Accenture

Reason 2: Reallocate expertise

Accenture reports that, “FP&A teams spend 85% of their time on tactical and labor-intensive production tasks to prepare data and just 15% of their time on generating insights.”

AI can take over these manual tasks that occupy so much of FP&A teams’ time, allowing FP&A professionals to reallocate their expertise to higher-value and higher-satisfaction work, such as generating actual insights from the data and becoming a conduit from finance to the business and vice versa.

Key takeaways:

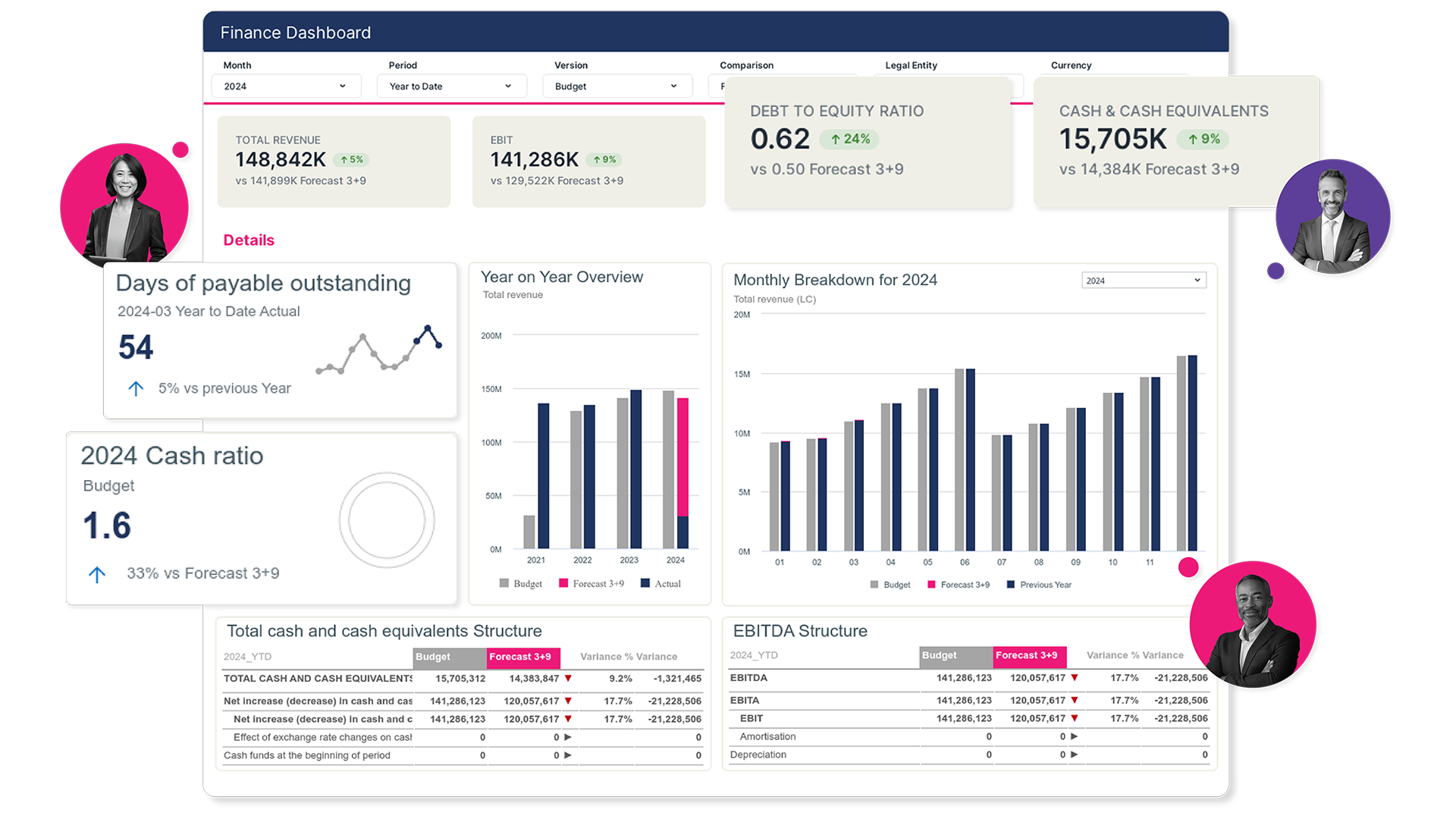

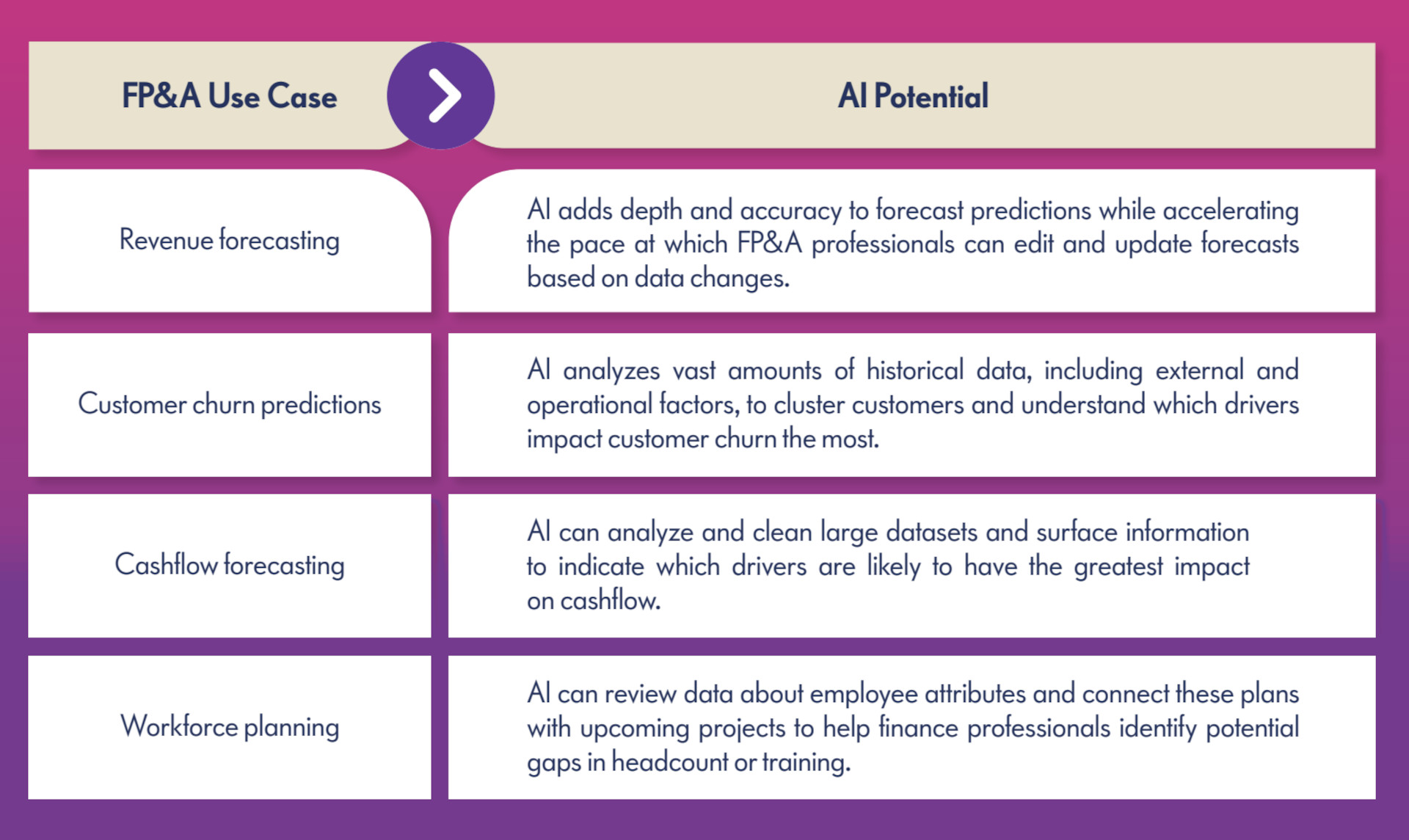

Common FP&A use cases and how AI can help

Once finance leaders are ready to invest in AI, what’s the most profitable place to start?

Review these use cases to see how AI can help.

Use case 1: Revenue forecasting

Gartner places demand/revenue forecasting at the top of their list of five recommended use cases for FP&A professionals. In fact, Mark D. McDonald, the Gartner Finance practice’s senior director of research, said this: “Organizations ignoring these use cases should have a good reason for doing so because they offer the best combination of feasibility and business benefit.”

1. AI adds depth and accuracy to forecasts

AI can increase the amount, quality, and granularity of the finance organization’s data by facilitating a data stream that brings together financial data and CRM data, together with insights from the field and other business units. This enables finance to work in concert with the organization to create a better plan that reflects the nuances of data sources, regions, SKUs, people, and more.

To protect every customer from inaccuracies in outlying data, the Jedox platform prepares and normalizes datasets so that teams can review flagged outliers in the data before AI analysis.

With AI, finance can not only conduct statistical analyses on its own internal historical data, but it can also connect to the key operational and external drivers that could impact the forecast (e.g. weather, delivery times, interest rates). This data adds depth and real-world color to each forecast.

Jedox integrates granular, third-party data points like these into forecasts so finance teams don’t have to worry about technical data management.

According to Gartner data, FP&A teams are using AI to deliver forecasts with 98.5% improved accuracy in hours instead of weeks.

2. AI accelerates forecast predicitons

Since AI-powered FP&A software cuts out manual data work and boosts connections to important data, FP&A teams can produce forecasts quickly and change them as needed, which means planning cycles can be shorter and more frequent. Smart automation and intelligent recommendations generated by AI and machine learning also provide guidance that will help teams cut down on time spent on forecast preparation.

Additionally, AI can surface important changes in the data that alert FP&A teams to issues immediately. This way, teams can make prompt, immediate updates to forecasts rather than finding issues a month or a quarter after they occur.

Pairing this speed with AI’s increased accuracy means that finance can get to quicker insights than ever before.

Use case 2: Customer churn predictions

Like demand forecasting, customer churn predictions become faster and more dependable with AI. AI can analyze historical data to cluster customers and understand which drivers impact customer churn the most, while incorporating third-party data (e.g. customer service interactions and escalations, common topics addressed, company revenue changes) to glean trends. With these predictions as a starting point, finance organizations can provide insights to customer-facing teams in time to implement mitigation strategies with at-risk customers or promote best practices gathered from the most loyal customers.

EY notes that FP&A’s role should evolve in order to provide more customer value:

Terminix gains customer retention insights with AI

The FP&A team at Terminix was tasked with providing a long list of customer insights: estimate churn, identify potential churn risks, determine the factors impacting their decision, along with recommending actions the company could take to prevent cancellations. These were all within the wheelhouse of the team of skilled finance professionals, but the sheer volume of data about customers and product attributes posed an initial challenge.

Terminix used Jedox AI to analyze a dataset with a variety of customer drivers and use it to predict customer loyalty. Within a very short project development time, they gained insight they didn’t have before with a higher confidence than they had previously. They discovered features that they hadn’t assumed would correlate with the data. These faster predictions are helping them determine any changes to their business processes, make those changes, and begin to see results on customer retention even faster.

Use case 3: Cashflow forecasting

With AI, FP&A can provide more thorough information to support management decisions, particularly with cashflow predictions. AI can analyze and clean large datasets to surface information like customers who don’t pay on time, special payment terms, and mix of customers. It’s easy to quickly bring in not only these financial data points, but a mix of the most important external and operational drivers that will affect cashflow as well.

With data like this at the ready, the FP&A function is fully equipped to confidently advise on capital expenditures, investments, or expansion plans. The team will be able to predict with greater accuracy scenarios like how many customers will pay late, early, or on time, etc. giving confidence to decision making. EY describes the ideal function for FP&A:

“FP&A uses customer demand signals as drivers of financial performance, providing near-real-time data insights that support responsive reallocation of resources to the products and services in highest demand.”

Use case 4: Workforce planning

Similarly, AI can enable FP&A teams to act as strategic partners in workforce planning. How? AI can synthesize large datasets covering skills, attrition rates, or certifications, and connect these plans with upcoming projects. AI can help identify gaps for finance professionals to review and recommend hiring and training moves to ensure the organization is well prepared. Even if finance has offered this guidance in the past, AI ensures that it will be deeper and more accurate.

EY paints the picture of this transformation:

When HR is looking for guidance on how to best move forward with workforce planning, FP&A teams can use AI to help become strategic business partners providing data-backed insights.

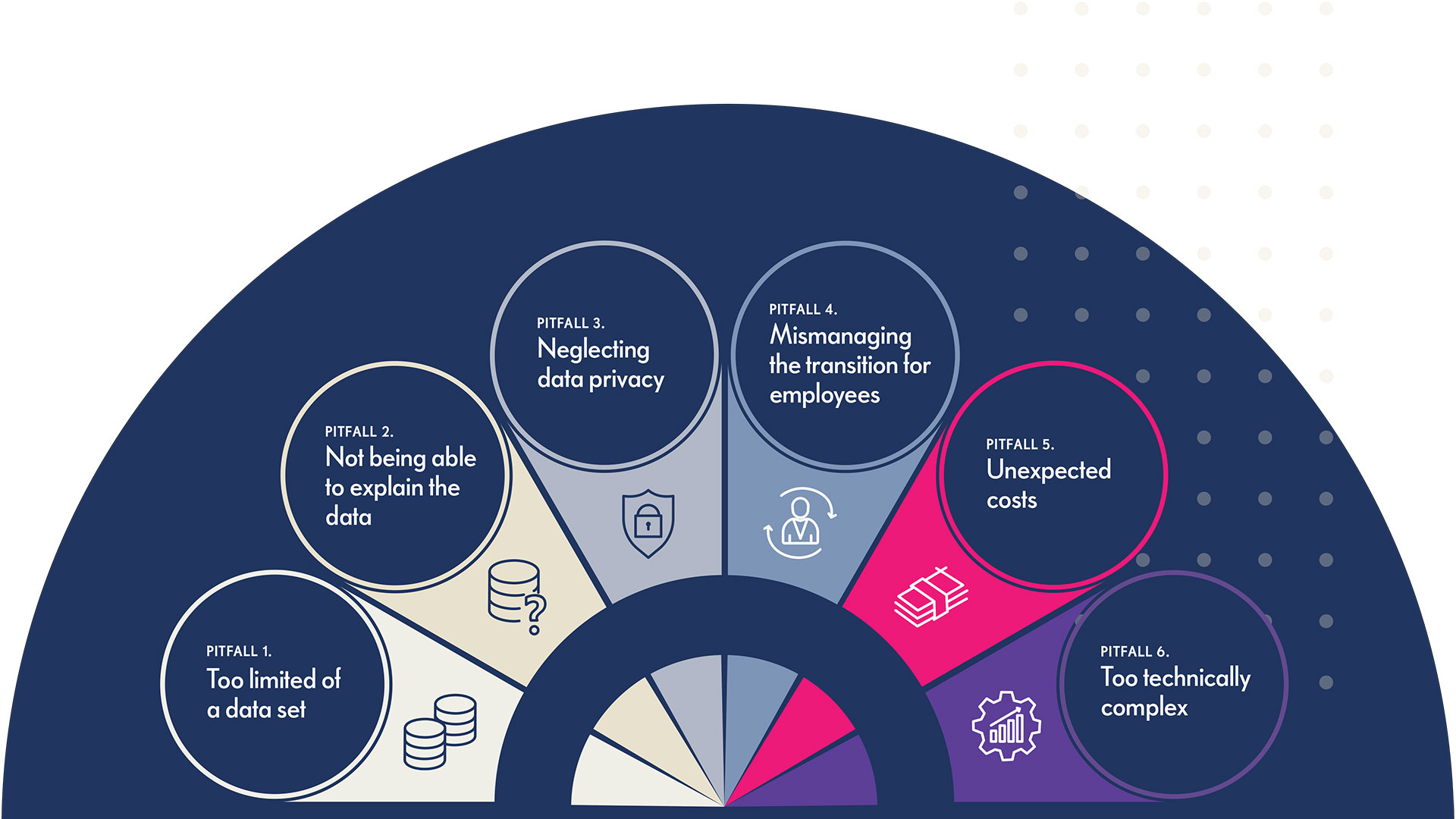

Caution: 6 AI pitfalls to avoid

While finance teams should certainly be optimistic about the future with AI, they should also maintain healthy caution. Follow trusted approaches that have proven results in order to avoid these AI pitfalls.

Too limited of a data set

The more data that AI has access to, the better results it can provide. The inverse is true as well. The organization could have the best AI tool in the world, but if it doesn’t have access to enough data, finance may miss out on crucial data points, leading to incomplete and distorted results, which could negatively affect final accuracy (and destroy the positive results of earned trust and reliability mentioned earlier).

To address this pitfall, expand the dataset feeding AI as much as possible to include internal financial data, operational drivers, and external drivers. Since AI can process terabytes of data at an incredibly high speed, incorporating more data isn’t difficult, and it will make answers that much more accurate.

The Jedox Integrator seamlessly connects any data source and visualizes data integration projects for non-technical users. FP&A teams can easily connect to internal data, operational drivers, and external drivers to provide terabytes of data that inform the AI plan, all of which improves the depth and accuracy of the finance team’s predictions and insights.

Not being able to explain the data

While AI can support a variety of work for finance professionals, it should never be divorced from human insights.

When using a large language model (LLM) form of AI, FP&A teams need to maintain oversight. If not, they risk losing trust from the business rather than building it. Blindly trusting in LLMs runs the risk of producing answers that are incorrect or don’t make sense, and rather than being confronted about one of these recommendations, FP&A teams must vet every conclusion and solution provided by AI.

Similarly, when using AI support for forecasting, FP&A teams need to be able to generally explain the data. Not manually analyze and prepare it, since that’s where AI is helping save time, but rather know which external data corresponds to results.

Jedox supports FP&A teams in this effort by providing a correlation coefficient report. This reporting details any movements in the AI forecast and which data corresponds to these numbers so that finance teams can easily explain any changes.

Neglecting data privacy

Data privacy is a concern for many organizations with AI, but FP&A teams have to be especially cautious due to the sensitivity of their data. Don’t neglect due diligence on privacy when searching for FP&A AI software, especially considering the strict consequences of breaching regulations.

The Jedox platform addresses these concerns by building every AI capability with security and privacy as top of mind. Data is protected from other customers, LLMs, and any third-party services, and is not used to improve LLM models like OpenAI.

Mismanaging the transition for employees

If finance leaders introduce AI capabilities without adoption expectations and a surrounding message to employees about the positive results for their jobs, it can lead to rigid responses from employees, and ultimately, project failure. The new capabilities should be showcased and explained to FP&A teams and an adoption plan rolled out, all while reminding teams that these new capabilities will make their jobs less cumbersome and more enjoyable. They won’t have to deal with arduous data preparation tasks anymore but rather be able to use their expertise for delivering valuable strategic insights for their organization.

Rather than reducing the potential of FP&A teams, AI will actually increase it. In proof of this, Gartner predicts that while, “90% of finance functions will deploy at least one AI-enabled technology solution . . . fewer than 10% will see headcount reductions as a result.”

Unexpected costs

AI projects come with price tags, whether the organization chooses to develop in house, purchase tokens, or invest in a SaaS product. These costs can balloon unexpectedly, especially with a trending technology like AI. When searching for any FP&A AI tool, finance leaders should consider vendor track record.

A history of success will help separate empty promise from proven performance and protect the organization from unexpected costs.

Too technically complex

Usability is crucial for successful adoption: The FP&A AI tool the organization invests in shouldn’t be so complex that the finance team users can’t do anything without consulting IT. They should be equipped to use the tool for the desired use case on their own.

A caveat: While the AI tool should be accessible to non-technical users in finance, finance leaders should ensure there is always someone who truly understands the data itself from a technical and business perspective working on the project.

The Jedox AI engine provides pre-built algorithms based on industry standard AI libraries so that finance teams have a direct solution pathway to information and insights they couldn’t get before. In addition, our wizard-based approach enables finance teams to eventually self-serve. They can run and deploy their own models without having to enlist IT or a consultant’s help.

Take the path to more trust, credibility, and leadership for finance teams

In the next few years, AI in FP&A will be a major force in helping transform finance teams from reactive to strategic, from bookkeeping to business partnering. Thanks to AI, we may even see the earlier statistic from Accenture turned on its head — perhaps FP&A teams will finally be able to spend 85% of their time on generating insights instead of on tactical and labor-intensive data preparation tasks. Unlike any other department, finance and their FP&A teams are uniquely positioned to deliver actionable insights that enable leadership to make decisions with confidence and that move the organization forward. Rather than waiting to see others lead the way, start investigating how you could use AI to accelerate your performance today.