Introduction

The financial planning and analysis (FP&A) landscape has changed dramatically over the last few years due to many challenges, including a global pandemic, geopolitical conflict, energy crises, climate change, cyberattacks, and remote work. In addition, a rapid rise in prices and interest rates started in 2022 and continues to garner international concern and action. In many countries, inflation has reached 40-year highs, and energy and food prices have seen the biggest price increases.

The impact of inflation has been felt worldwide as people struggle to afford the rapidly increasing costs of basic needs such as housing, food, and energy. Inflation also affects organizations as rising costs of labor and raw materials strain profit margins. Inflation has historically been relatively stable throughout the developed world and has been a simple assumption based on historical trends; however, today’s turbulent times require organizations to not only manage inflation, but plan for it as well.

“Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone. The burdens of high inflation fall heaviest on those who are least able to bear them.1”

Jerome Powell, Chair of the US Federal Reserve

The inflationary environment in 2022 and beyond

There are many causes of inflation, but the commonality is almost always a decrease in supply or an increase in demand that results in higher prices that eventually bring supply and demand back into equilibrium. Over the last few years, a few major reasons for the increase in prices has been supply chain disruption, reduction in oil production, and other energy-related factors. To better understand and adapt to inflation, finance professionals should remember three key points:

- 1Inflation is a global problem, and rates vary by country

- 2There are many different indexes that help measure inflation, and each provides unique insights

- 3Inflation affects industries differently

Inflation is an increase in prices over time that results in a decline of purchasing power.

Inflation is often measured at different time intervals against a determined “basket of goods” containing consumer goods purchased by a typical household. For example, if the basket cost US$100 on January 1st, 2021, and US$105 on January 1st, 2022, the rate of inflation year over year would be 5%. This means it would cost 5% more to buy the same basket of goods as it did a year ago.

Challenges organizations face in managing inflation2:

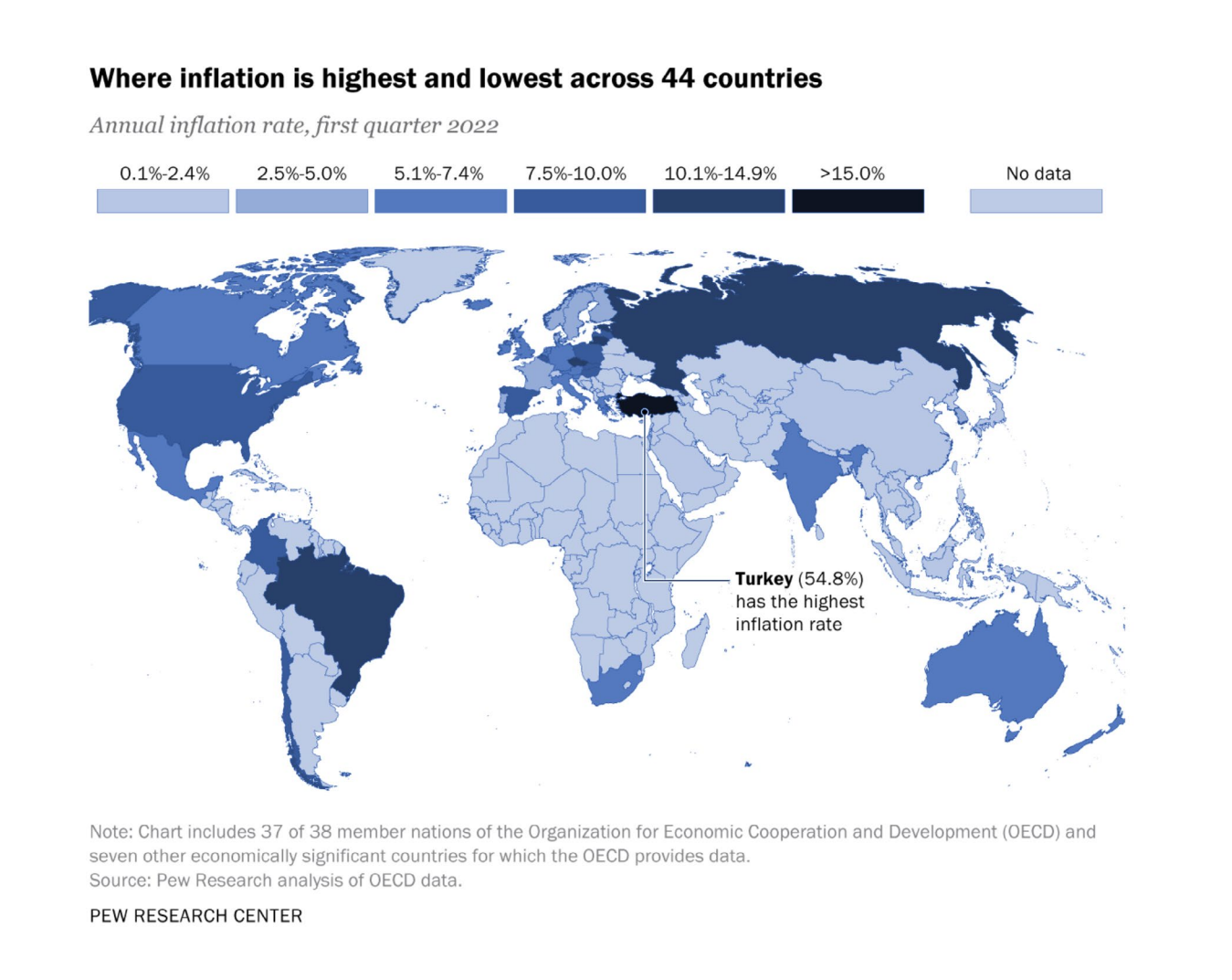

Inflation: a global problem

This Pew Research Center graph3 from Q1 2022 demonstrates the global and pervasive nature of inflation, which continued to fluctuate throughout 2022. Inflation rates have differed substantially by country, discrepancies that highlight the complexity of inflation, and the importance of developing a strategy for planning and managing in an inflationary environment.

Inflation indexes

As referenced in Table 1, many different indexes exist for measuring inflation. Each addresses how inflation impacts different groups, as well as how certain materials or items impact the overall inflation rate. For example, housing is a noteworthy item that can have a disproportionate and targeted impact on inflation. Skyrocketing housing prices in a particular region can raise the total inflation rate; however, if the inflation rate of other expenses is flat or slightly down, other organizations and products may not be impacted. This example highlights the importance of understanding the different indexes and what they mean.

In general, most countries have a few major indexes that measure inflation, including:

When finance professionals determine which index and forecast to rely on for planning, it is important to understand what each index includes in its calculations, and which indexes are most relevant and appropriate to use for a particular organization. See Table 1 for a list of widely used indexes and resources.

Inflation rates by industry

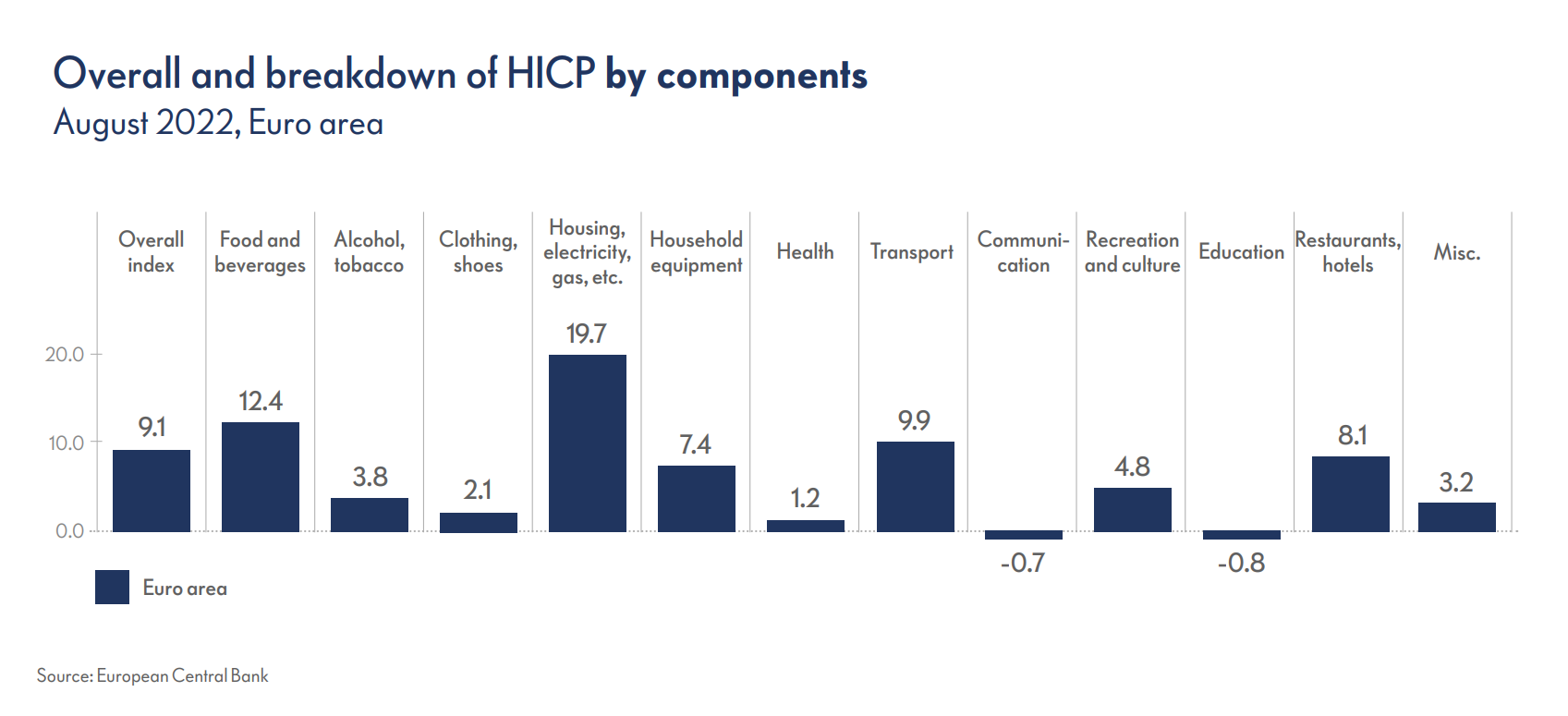

Inflation, and all the uncertainty we have experienced over the last few years, has had a big impact on finance in general and planning specifically. This graph from the European Central Bank4 illustrates the degree to which there is volatility and inconsistency in inflation rates across different industries. According to the eurozone HICP, the industry-specific inflation rate ranges from -.8% for education to 19.7% for housing, electricity, and gas. It is critical for finance professionals to understand how inflation affects respective industries, the current inputs, and the assumptions that can be used to model it over the coming months and years. For example, an industry that is heavily affected by energy and food prices demands different assumptions from those in the education industry.

Other external drivers to consider

The last few years of constant change and uncertainty have increased the need to incorporate external drivers into the planning process. By doing so, organizations can improve the overall accuracy of forecast predictions. Common externalities that finance professionals can consider in their planning process include interest rates, foreign exchange (FX) rates, and commodity prices.

Interest rates are an external driver that every organization needs to consider. Given they are a main tool used by governments to combat inflation, interest rates can have a much bigger impact during inflationary times because of their impact on the costs of borrowing capital and holding capital. FP&A departments must work closely with treasury to ensure their organizations have a plan in place to manage the impact of fluctuating interest rates.

During times of economic uncertainty, FX rates often fluctuate. For example, The UK’s departure from the eurozone caused the pound to decline substantially. Sudden movements in FX rates can have a material impact on organizations that don’t have a plan in place that both mitigates the risks and captures the potential upside of fluctuating FX rates.

In addition to interest rates and FX rates, additional external drivers will need to be considered, including oil, energy, and weather. In addition to incorporating external drivers into the planning process, it is essential to conduct sensitivity analysis and run multiple scenarios to understand how different situations could impact an organization.

Adapting to an inflationary environment: a threefold approach

Over the last few years, FP&A professionals have scrambled to keep up with the workload resulting from seemingly endless volatility. Six trends have emerged5:

- 1

Increase in number and cadence of forecasts since the COVID-19 pandemic

- 2Decrease in satisfaction in forecasts

- 3Increase in demand for integration of external data

- 4Increased need for coordination between the broader business and FP&A professionals

- 5Increased need to quickly model multiple different scenarios

- 6Increase in cash on hand as organizations manage the risk of economic uncertainty

FP&A professionals face a conundrum: as they struggle to keep up with the demands placed upon them, they also face lower satisfaction rates with the forecasts they produce. Due to these changes, it has become more important than ever for FP&A professionals to adapt to these turbulent times so organizations can remain resilient.

There are three key ways in which FP&A professionals must adapt to an inflationary environment:

- 1

Business partnering

- 2

Predictive planning technology

- 3

Sensitivity analysis and scenario planning

1. Business partnering

There is a direct correlation between economic uncertainty and business partnering: more uncertainty demands closer partnering between FP&A professionals and the broader organization. FP&A professionals must embrace their role as strategic advisors to their organizations, a role that requires consistent and meaningful interaction with people across all departments.

FP&A professionals must not merely receive but instead co-create strategies for both managing and planning for the characteristic volatility of our current environment. As business partners, they can review the following factors for opportunities to increase revenue and/or reduce expenses:

2. Predictive planning technology

With the ever-increasing need to include external drivers, sensitivity analysis, and a review of multiple different scenarios, the need for transformation in financial planning and performance management is more important than ever. According to the FP&A Trends Survey 2022, respondents who utilized technology were happier with the forecast than those who did not. Only 39% of respondents rated forecast satisfaction as either good or great; however, the number jumped to 50% for organizations using a cloud-based planning tool and 63% for those using artificial intelligence (AI) as part of the planning process.6

According to a recent BARC topical survey7, the use of predictive planning is skyrocketing: one in four organizations already use predictive algorithms and machine learning productively as they seek ways to produce their plans and forecasts in less time, with less effort, and with better and more accurate results. Key findings from the survey include the following:

Companies need to embrace predictive planning and AI technology as an enabler of a more robust and complete planning process. The technology alone will not magically make an existing plan more accurate; however, it can and does enable organizations to gain greater insights into drivers of KPIs and to use these drivers, plus drivers they can import from third parties such as commodities pricing fluctuations, to build data-backed plans that inform confident decisions. A robust cloud-based planning tool can make it easier to collaborate across the business, implement external drivers, use AI and machine learning to illuminate trends, alerts, and opportunities, and compare various business scenarios.

Despite the opportunities that predictive planning and AI technology offer to finance professionals, misconceptions abound regarding its impact. Four of the most common include8:

3. Sensitivity analysis and scenario planning

Sensitivity analysis is the process of taking a key input and seeing how a key driver changes because of that input. An example of a sensitivity analysis is taking the cost of lumber and seeing the impact on a building contractor’s overall profitability at different lumber cost points. Running a sensitivity analysis on key drivers and inputs can help FP&A professionals determine how each driver and input will affect the overall financial health of the organization. One way to start is by taking the top three to five expense drivers and running a sensitivity analysis on each of the inputs to see how rising costs will affect overall financial health. Doing this will help determine when an organization may need to raise more cash or increase prices to ensure its overall well-being and financial health.

A static budget with only a point estimate is no longer sufficient in today‘s rapidly changing environment, and the need to run multiple scenarios is more important than ever. Every organization should build plans for how they will operate and manage based on different scenarios that could occur in the coming months and years. Every organization should ask themselves: what will we do if inflation stays stubbornly high for the next two to three years? What will we do if the global economy heads into a major recession? These questions are the first step in modeling and planning for potential scenarios.

The FP&A department is perfectly positioned to help ensure the business not only runs multiple scenarios but also develops plans that can be enacted based on which scenario plays out over time. Let’s take a brief look at three external drivers and potential scenarios to consider in the planning process.

External driver: climate change

Organizations can model different scenarios based on potential government regulation, technological innovation, and industry shifts that will occur as part of an effort to combat the impact of climate change. For example, an organization that sells internal combustion engines can model scenarios around what would happen if the government severely restricted and/or banned the sale of its products. In this example, the organization would need to consider the impact on revenue for each product, how R&D expenses would change, and what capital investments would need to be made in order for the organization to capitalize on the new environment.

External driver: remote work

When the the COVID-19 pandemic shut down in-office work and organizations moved to remote work, an opportunity existed for finance to play a key role in guiding them through remote working environments. Finance departments created multiple scenarios by looking at rent costs, travel expenses, and other costs required to support various work environments, including:

External driver: geopolitical conflict

Global organizations need to consider geopolitics, especially given the impact the war in Ukraine continues to have on the global economy. In this environment, countries can take several different approaches to how they will respond and engage on the world stage, and this can impact organizations depending on where they are based and where they conduct business activity.

A recent EY study identified four plausible geopolitical scenarios 9 that finance professionals can consider when scenario planning for their organizations:

Finance professionals can partner with the broader business to determine which scenario(s) could impact their organization’s business activities, customers, revenue, office locations, etc. and build these scenarios into their planning process.

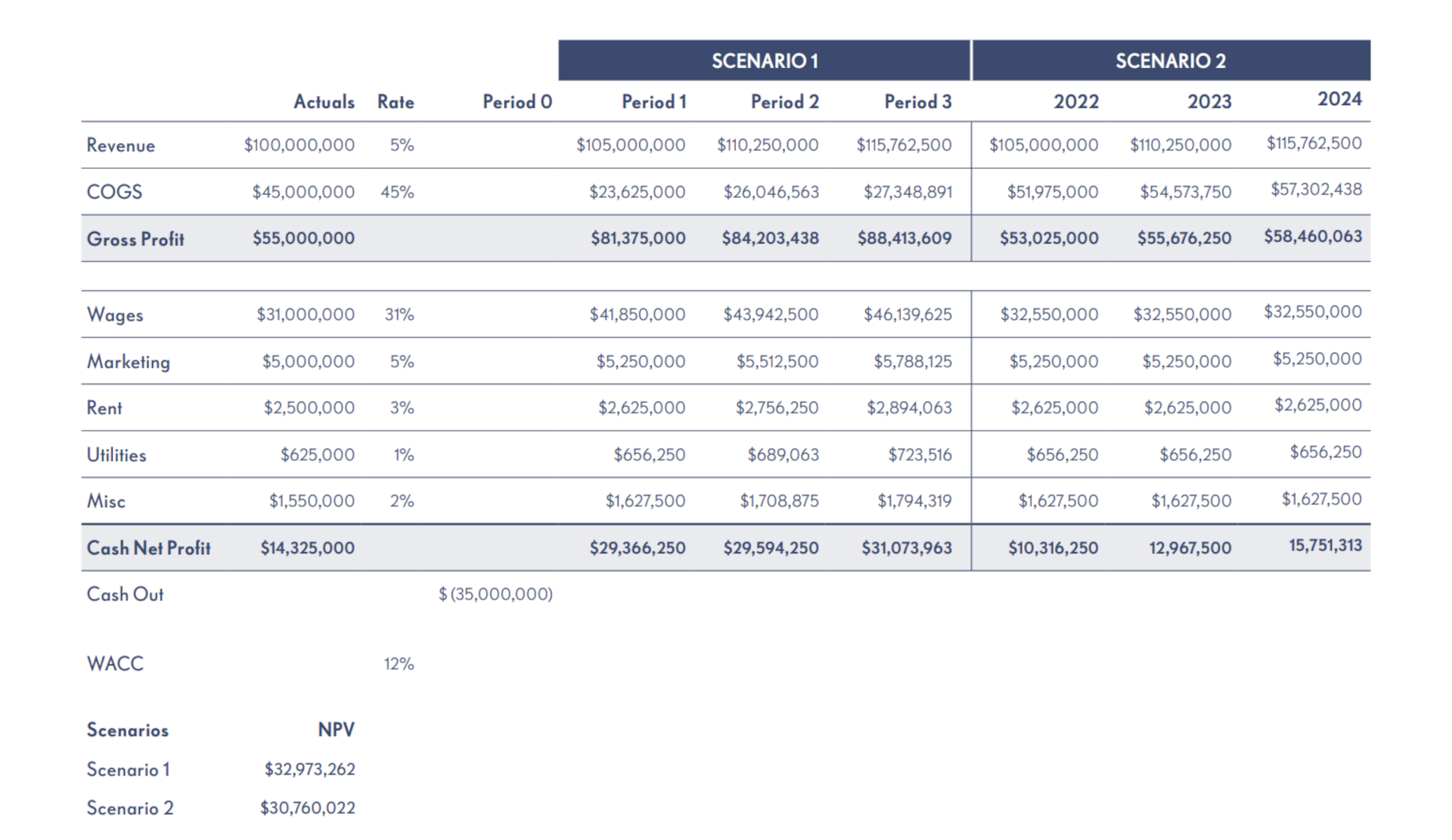

Table 2 shows the basic process of what a scenario analysis might look like between the two options. A net present value (NPV) analysis shows what the NPV would be in each scenario. In addition, running a sensitivity analysis can illuminate what happens when certain assumptions are changed.

This example provides a few different options:

Developing a robust, automated, and predictive planning process to analyze and determine what business activities look like under different scenarios will increase the likelihood of an organization achieving its strategic objectives and financial targets.

Conclusion

FP&A professionals must help the business manage an inflationary environment by incorporating business partnering, predictive planning technology, and sensitivity analysis and scenario planning in their planning processes moving forward.The opportunity for FP&A professionals to make a real impact on their organizations increases during times of uncertainty, and helping them adapt to this changing environment allows the finance organization to continue evolving from a back-office function to that of a value-added strategic partner.

References

1 Federal Reserve, Monetary Policy and Price Stability, August 26, 2022

2 KPMG, 2022 KPMG Inflation Survey: Key survey takeaways, 2022

3 Pew Research Center, Where inflation is highest and lowest across 44 countries, 2022

4 European Central Bank, Measuring inflation – the Harmonised Index of Consumer Prices(HICP), September 16, 2022

5 Deloitte, Reinventing FP&A for the pandemic and beyond, 2020

6 FP&A Trends, FP&A Trends Survey 2022: How Technology Advances FP&A to the Role of Strategic Advisor, July 2022

7 BARC, Predictive Planning and Forecasting on the Rise – Hype or Reality?, 2022

8 Jedox, Four misconceptions about AI in finance organizations, 2022

9 EY, The CEO Imperative: Prepare now for the new era of globalization, September 2022

Authors

Tim Caudill

Director of Americas Solution Advisory, Jedox Inc.

Paul Barnhurst

Founder, The FP&A Guy

Phoebe Schmalz-Ziekow

Product Manager, Jedox GmbH